Morning Market Update - 12 July 2021

Cutcher & Neale

11 July 2021

17 July 2023

minutes

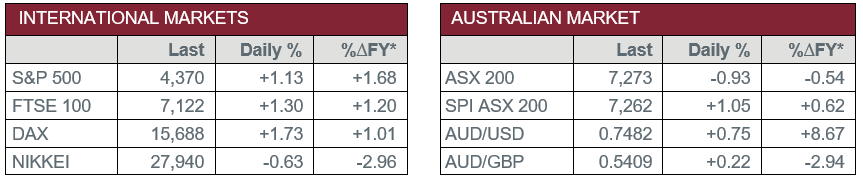

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions and Confidence

- Tuesday – CHINA – Trade Balance

- Wednesday – AUS – Consumer Sentiment

- Wednesday – EUR – Industrial Production

- Thursday – AUS – Unemployment Rate

- Thursday – UK – Unemployment Rate

- Friday – EUR – Trade Balance

- Friday – US – Retail Sales

Australian Market

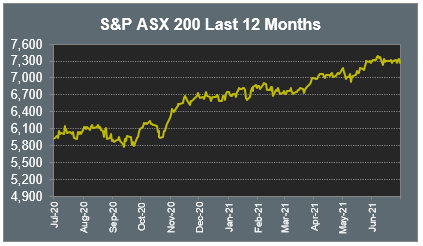

The Australian sharemarket fell 0.9% on Friday, to close the week 0.5% lower, after being caught up in a sell-off in overseas markets on Thursday night. The Information Technology sector was the weakest performer, down nearly 3%, dragged lower by Afterpay and Zip, which lost 5.0% and 5.5% respectively.

Travel companies suffered as extended lockdowns for Sydney were imposed as the Delta variant continues to spread; Webjet fell 5.7%, Flight Centre was down 3.9% and Qantas slipped 2.7%. Sydney Airport lost 1.0%, however, remained up over 33% for the week thanks to takeover interest in the company.

The Financials sector also weakened; the big four banks all lost between 0.3% and 0.9%, with Commonwealth Bank the weakest performer.

BHP and Rio Tinto fell 0.4% and 0.7% respectively, to weigh on the Materials sector, while Fortescue Metals bucked the trend to rise 0.7%.

The Australian futures point to a 1.05% rise today, driven by stronger overseas markets on Friday.

Overseas Markets

European sharemarkets lifted over 1% on Friday, rebounding from Thursday’s weakness, to post their best session in two months and erase the week’s losses. Over the course of the week, the broad based STOXX Europe 600 added 0.2%.

US sharemarkets also closed higher on Friday ahead of the beginning of earnings announcements this week. Amazon slipped 0.3%, however, added 5.9% for the first week under the leadership of Andy Jassy, fuelled in part by the Pentagon’s announcement it will scrap the US$10 billion contract it awarded to Microsoft in 2019 and divide the job between the two companies. BlackRock added 2.8%, while Spotify and Shopify gained 2.6% and 2.2% respectively.

Over the week, the Dow Jones lifted 0.2%, while the S&P 500 and the NASDAQ both added 0.4%.

CNIS Perspective

When the music industry switched from analog to digital, physical music sales collapsed as consumers were able to access free and pirated music over the internet, with a whole generation born into the belief that access to music was free. This led to court battles between the free music file sharing website Napster and Metallica’s drummer Lars Ulrich, which dominated headlines in the year 2000. Whilst Napster lost the court case, consumers, or the early adopters at least, had moved on from records, cassettes and CD’s and enjoyed the ability to hold compressed music files on an MP3 player. This evolved into the first iPod in 2001, a 5GB device designed to put "1,000 songs in your pocket", which paved the way to a revolution in how music and movies are purchased today, not to mention preparing the ground for the iPhone.

This evolution of accessing music digitally has continued with the launch of Spotify, the Swedish music streaming platform launched in 2008. Spotify lists 50 million songs in its library, with 40,000 new songs uploaded every day and 286 million monthly active users. In 2016 a tipping point was reached when streaming revenue surpassed physical music sales for the first time and now accounts for more than 80% of total recorded music revenue.

Other platforms such as TikTok and YouTube are also huge parts of music consumption. A TikTok video of a cranberry-drinking skateboarder went viral last year, sending a Fleetwood Mac album back onto the Billboard charts for the first time in four decades, providing an indication of its influence. Despite this, these platforms are currently barely contributing to music revenues.

Digital music consumption boomed during the lockdown, with the industry posting its fifth straight year of growth, putting the industry near its record revenue in 1999. While streaming will remain the key revenue driver for years to come for the music industry, we remain interested in this evolving and innovative industry and what further investment opportunities arise.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.