Morning Market Update - 12 November 2021

Cutcher & Neale

11 November 2021

17 July 2023

minutes

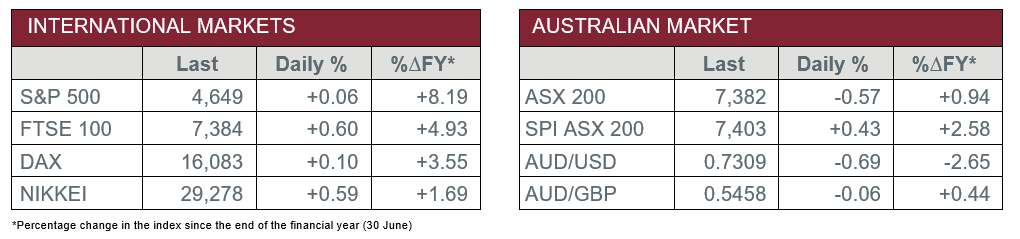

Pre-Open Data

Key Data for the Week

- Thursday – AUS – Unemployment Rate rose 0.6% in October to 5.2%, up from 4.6% in September.

- Friday – AUS – Retail Sales

- Friday – UK – Nationwide House Prices

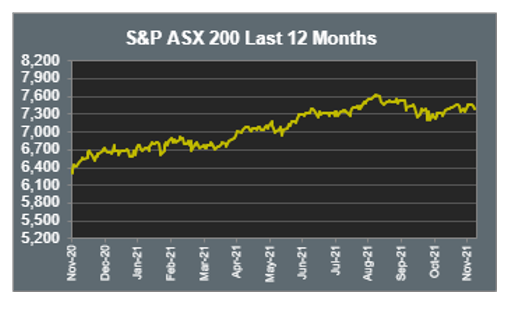

Australian Market

The Australian sharemarket extended losses yesterday, down 0.6%, dragged lower by the Information Technology sector (-2.5%). Key movers in the sector included buy now pay later provider Zip (-5.2%) and Xero (-6.2%), which were among the worst performers in yesterday’s session.

Most sectors lost ground on Thursday, except for Materials (2.3%) and Telecommunications Services (0.8%). Iron ore miners performed strongly, with Fortescue Metals Group (8.2%) being a stand out, as investors digested news around its renewable energy plans. Sector heavyweights BHP (2.6%) and Rio Tinto (1.9%) also performed well. Telecommunications giant Telstra added 0.5%, alongside online job advertiser Seek, which gained 3.0%, as COVID-19 lockdowns ease and the employment participation rate rises.

The Health Care sector (-2.2%) weakened after its primary constituent, CSL Limited, gave up 2.4%. Other major movers included Ramsay Health Care (-4.0%), Sonic Healthcare (-1.7%) and Fisher & Paykel Healthcare (-0.5%).

The Financials sector (-0.9%) conceded gains made on Wednesday, as all four major banks closed lower. Losses were led by Commonwealth Bank and NAB, which both gave up ~1.6%, while Westpac and ANZ inched between 0.1-0.2% lower. Another notable mover was fund manager Australian Ethical Investment, which closed down 3.0%.

The Australian futures point to a 0.43% rise today.

Overseas Markets

European sharemarkets closed at record highs again on Thursday, as overall market sentiment was buoyed by strong earnings reports and alleviated concerns around indebted Chinese property developer, Evergrande, which benefited mining stocks. Reports that Evergrande once again avoided default led to an uplift in iron ore and copper prices overnight. Key performers included London listed BHP (3.9%) and Rio Tinto (3.4%). The STOXX Europe 600 (0.3%), German DAX (0.1%) and UK FTSE 100 (0.6%) all closed higher.

US sharemarkets were mixed on Thursday, as the Dow Jones lost 0.4%, the NASDAQ gained 0.5% and the S&P 500 closed relatively flat. The Information Technology sector (0.5%) recovered modestly, while the Materials sector (0.9%) was the strongest performer, propped up by commodity prices and the news around Evergrande. Notable gainers included chip designer, NVIDIA (3.2%), and music streaming platform, Spotify (2.5%), alongside solar energy related stocks Enphase Energy (8.2%) and SolarEdge Technologies (4.4%). Meanwhile, weak performers included digital payment providers PayPal (-1.3%) and Visa (-2.4%).

CNIS Perspective

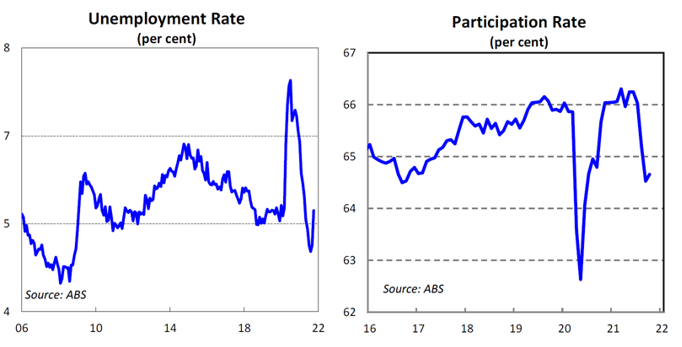

The unemployment rate is not always the most reliable indicator of the health of the labour market, due to the participation rate.

The participation rate reflects the total amount of people within the labour force, whereas the unemployment rate measures the number of workers within the labour force without a job.

Employment data for October released yesterday showed the participation rate increasing 0.2% to 64.7%, a 15-month high, as tens of thousands of people re-entered the workforce ahead of lockdowns easing, particularly in Victoria. This is largely why the unemployment rate ticked higher, rising 0.6% to 5.2%, its highest level since April.

In the short term, as easing of restrictions continue, and as more workers return to the labour force, it remains possible the unemployment rate will also tick up.

However, looking past the short term noise, business confidence is still on the rise and business balance sheets are broadly in good shape, which should bode well for employment opportunities as many businesses are still not operating at full capacity.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.