Morning Market Update - 14 June 2022

Cutcher & Neale

13 June 2022

17 July 2023

minutes

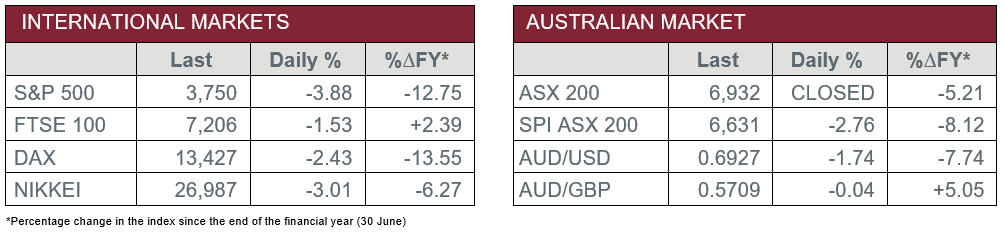

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – NAB Business Conditions and Confidence

- Tuesday – EUR – Industrial Production

- Tuesday – UK – Unemployment Rate

- Wednesday – CHINA – Retail Sales

- Wednesday – US – FOMC Meeting

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Policy Meeting

- Friday – EUR – Consumer Price Index

Australian Market

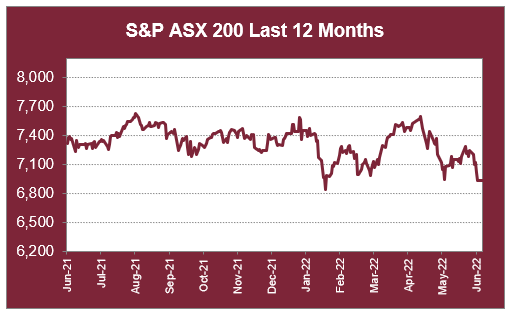

The Australian sharemarket was closed yesterday for the Queen’s Birthday long weekend, however, ended lower on Friday. This comes after the Reserve Bank of Australia increased the cash rate by 0.5% earlier in the week in an attempt to combat rising inflation.

The Financials sector was among the hardest hit, as it lost 9.0% over the week. Commonwealth Bank and ANZ both dropped 1.2%, while Westpac and NAB conceded 1.5% and 0.7% respectively. Local fund managers also lost ground; Australian Ethical Investment lost 0.6%, while Magellan Financial Group dropped 4.2%.

Losses were also seen in the Consumer Discretionary sector, given the impact increased interest rates could have on household savings. As a result, JB Hi-Fi lost 0.6% and Harvey Norman slipped 3.6%, while Wesfarmers closed the session 2.5% lower.

Despite the price of oil remaining stable, the Energy sector lost 1.6%, however ended the week in positive territory. On Friday, Woodside Energy fell 1.6% and Santos conceded 1.5%.

The Australian futures market points to a 2.76% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets closed lower on Monday, as all sectors finished the session in negative territory. The Information Technology sector underperformed; Infineon Technologies dropped 6.8%, while ASML Holdings fell 4.4%. The Travel & Leisure sector was also weaker, as Lufthansa and International Consolidated Airlines dropped 3.9% and 3.8% respectively, while easyJet slipped 6.4%.

By the close of trade, the STOXX Europe 600 and the German DAX both shed 2.4%, while the UK’s FTSE 100 dropped 1.5%.

US sharemarkets also ended lower overnight, as inflationary worries remained amongst investors, with the Information Technology sector the hardest hit. Netflix led the losses, down 7.2%, while Amazon dropped 5.5% and Apple closed the session 3.8% lower. By the close of trade, the Dow Jones dropped 2.8% and the S&P 500 lost 3.9%, while the NASDAQ fell 4.7%.

CNIS Perspective

Friday night's May US CPI came in much hotter than expectations, with the annual inflation rate rising to 8.6%, and up from 8.3% in April.

While rate hikes have been commonplace in recent months, the subdued impact of the 75 basis points of rises to date is showing that inflation is going to remain higher for a longer period.

The inflation spike seems solely now a supply side problem the Federal Reserve is dealing with, with rising food, shelter, gas and energy prices amongst the major contributors to the gain.

While on the demand side, the Federal Reserve is succeeding in their task of weakening consumer demand, with a consumer sentiment measure also released on Friday night at its lowest reading since 1978.

The CPI result paves the way for another 50 basis point rate hike at this week’s meeting, and market expectations for July and September to do the same is also now a high probability. However, with the slower effects of monetary policy to influence supply driven price spikes, we can expect this elevated inflation level to persist late into the second half of the year.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.