Morning Market Update - 14 October 2020

Cutcher & Neale

13 October 2020

17 July 2023

minutes

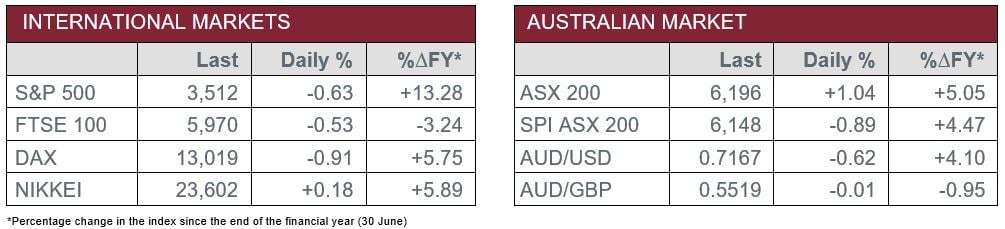

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – UK – ILO Unemployment Rate rose to 4.5% for the three months to August, the highest level in three years.

- Tuesday – US – Consumer Price Index was 0.2% for September, in line with expectations, while on an annual basis CPI rose to 1.4%, from 1.3% in August.

- Wednesday – AUS – HIA New Home Sales

- Wednesday – US – Producer Price Index

Australian Market

The Australian sharemarket rose 1.0% yesterday, to close higher for the seventh-straight session, as the local market reached its highest level since the downfall in March. All sectors closed higher except for Materials, which were weighed down by mining heavyweights as Fortescue Metals slipped 1.4% and BHP lost 0.4%.

Telstra rose 4.0% to help lift the Telecommunications sector after the company reiterated its FY21 guidance at its AGM. Chairman John Mullen also announced the board wants to ensure investors dividends are not cut from its current payout of $0.16 per share.

The Financials sector also outperformed, led higher by the big four banks; ANZ lifted 2.7%, Westpac and NAB rose 2.2% and 1.9% respectively, while Commonwealth Bank added 1.1%.

Woodside Petroleum rose 0.8% after the company announced it will cut 300 jobs, or nearly 8% of its workforce.

The Australian futures market points to a 0.89% fall today, driven by weaker overseas markets overnight.

Overseas Markets

European sharemarkets were weaker on Tuesday as the broad based STOXX Europe 600 fell 0.6%. The Financials sector was amongst the weakest performers; Lloyds Bank and Barclays fell 4.3% and 3.5% respectively. Industrials stocks also weakened; Eiffage and Veolia fell 3.1% and 3.0% respectively, while Vinci lost 2.6%. Consumer stocks were mostly higher; HelloFresh added 1.8%, Tesco rose 1.5% and Nestlé gained 0.1%.

US sharemarkets closed lower overnight to end four-straight sessions of gains. Financials were the weakest performers as JP Morgan and Citigroup fell 1.6% and 4.9% respectively. Johnson & Johnson slipped 2.3% after it temporarily halted its study of a COVID-19 vaccine. Apple fell 2.7% after the company unveiled its new 5G iPhone 12 products, the share price fall came after an over 6% rise on Monday in the lead up to the unveiling. Spotify was amongst the best performers up 6.2%, while PayPal gained 3.1%.

CNIS Perspective

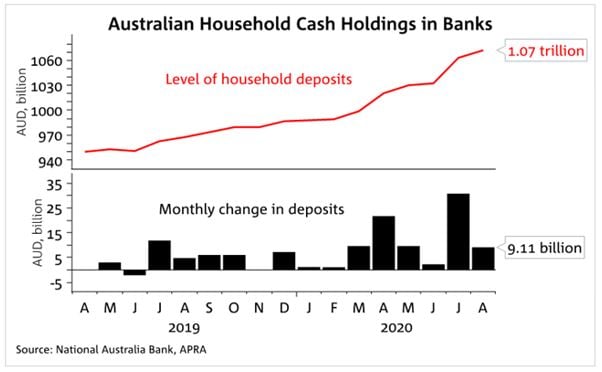

As we step into the last quarter of the year, a period of generally higher consumer spending heading into Christmas, you may expect the 2020 season could see a level of conservatism on consumers part. However, this may not be the case if you look at Australian household cash holdings.

Australians have been stockpiling cash over the last six months, whether it be from super withdrawals, Government support payments or free childcare. The statistics show, as a nation we are sitting on a cumulative additional $83.1 billion (or 8.4% above February levels) in bank accounts compared to pre-COVID-19 levels.

It’s only a matter of time before this level of cash starts to burn a hole in consumers’ pockets.

As employment continues to rebound, tax cuts flow through to bank accounts and consumers feel more comfortable with their personal situation heading into Christmas, expect a retail spending splurge.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.