Morning Market Update - 15 June 2021

Cutcher & Neale

14 June 2021

17 July 2023

minutes

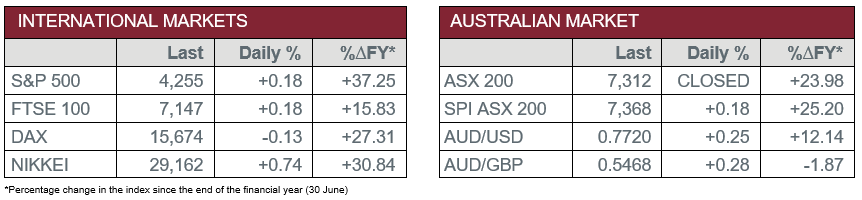

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – ABS House Prices

- Tuesday – US – Retail Sales

- Tuesday – US – Industrial Production

- Tuesday – EUR – Consumer Price Index

- Wednesday – CHINA – Retail Sales

- Wednesday – UK – Consumer Price Index

- Wednesday – US – FOMC Policy Decision

- Thursday – EUR – Consumer Price Index

- Friday – UK – Industrial Production

Australian Market

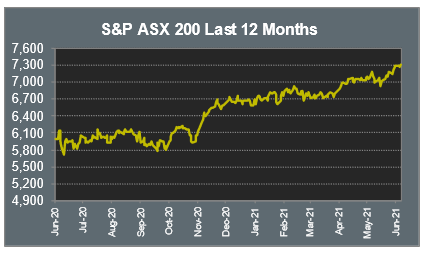

The Australian sharemarket resumes trading today following the long weekend. On Friday, the ASX 200 added 0.1% to finish the week at a record closing level. Most sectors posted gains, with Information Technology and Materials the best performers.

Despite rising inflation data from the US, the Information Technology sector added 1.3%, as analysts explained that the majority of increasing prices in the US came from commodities and airlines. Buy-now-pay-later providers Afterpay and Zip lifted 3.7% and 4.1% respectively, while artificial intelligence producer, Appen, added 5.6%.

The Materials sector was lifted by increases in the mining heavyweights; Fortescue Metals climbed 1.7%, BHP added 1.4% and Rio Tinto eked out a less than 0.1% gain. Gold miners outperformed; Northern Star Resources jumped 4.5% and Evolution Mining added 2.8%.

The Financials sector was the main detractor, shedding 0.8% as ANZ was the worst performer of the big four, losing 1.5%.

The Australian futures market points to a 0.18% rise today.

Overseas Markets

European sharemarkets extended gains on Monday as the pan-European STOXX 600 index rose 0.2%. Energy shares outperformed as the price of oil increased to a new two-year high. As a result of the increased demand for oil, Royal Dutch Shell lifted 2.7%, and BP added 1.8%.

US sharemarkets also closed mostly higher on Monday, with the S&P Technology index closing just below its record high, aided by gains in Spotify (3.2%), Apple (2.5%) and Amazon (1.1%). Electric vehicle manufacturer, Tesla, added 1.3% after it was announced that the company would resume Bitcoin transactions when miners use more renewable energy. By the close of the session, the Dow Jones lost 0.3%, the S&P 500 gained 0.2% and the NASDAQ added 0.7%.

CNIS Perspective

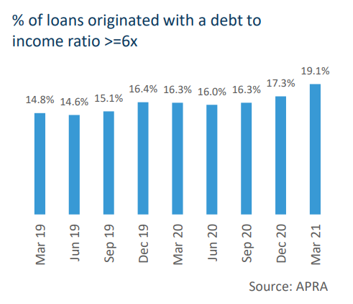

Australian households are beginning to take on riskier levels of debt according to APRA’s recent data on household income to debt comparisons.

It is of no surprise that we are seeing increased borrowing levels as house prices continue to spike, however, incomes aren’t rising anywhere near the required pace to maintain household debt/income ratios. The rise in house prices is purely being funded by higher levels of debt, due to record low borrowing rates.

Households with debt greater than six times gross income is a figure deemed ‘risky’ by APRA.

The percentage of mortgages written at high loan/debt to income ratios has risen sharply over recent quarters, with loans above six times income rising to just under 20% of loans originated in the March quarter, as homebuyers rush into the market, with the fear of missing out becoming a real prospect.

At present, it is unlikely APRA will step in and restrict lenders from providing higher risk loans, with serviceability manageable at current interest rates.

However, this must be making policymakers a little uneasy, with the flexibility of raising interest rates at some point in the future becoming increasingly difficult, if servicing debt on Australian’s largest asset becomes unaffordable. The last thing they would want to see is higher rates stifling consumer spending and economic growth.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.