Morning Market Update - 15 March 2021

Cutcher & Neale

14 March 2021

17 July 2023

minutes

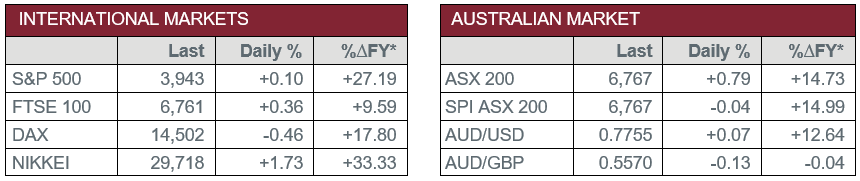

Pre-Open Data

Key Data for the Week

- Monday – AUS – HIA New Home Sales

- Monday – CHINA – Retail Sales

- Tuesday – AUS – RBA Meeting Minutes

- Tuesday – US – Retail Sales

- Wednesday – EUR – Consumer Price Index

- Wednesday – US – Fed Interest Rate Decision

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Interest Rate Decision

- Friday – AUS – Retail Sales

Australian Market

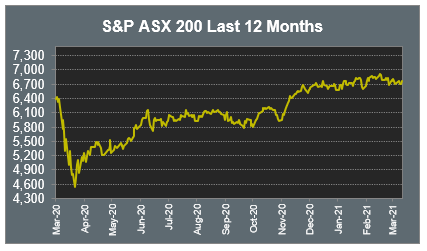

The Australian sharemarket closed 0.79% higher on Friday to post its best weekly improvement in over a month. Gains across the market were broad based as all sectors ended the session in the positive, with Consumer Discretionary, Industrials and Information Technology amongst the best performers. Friday’s rally followed a firmer session in the US, after President Biden signed a new US$1.9 trillion stimulus bill.

Stronger iron ore prices drove mining heavyweights BHP and Rio Tinto up 2.5% and 0.8% respectively, while Fortescue Metals climbed 2.3%. Oil stocks were also buoyed by higher commodity prices; Oil Search strengthened 1.9%, Woodside Petroleum rose 1.4% and Santos added 0.7%.

Gains in the Financials sector were limited by mixed performances by the big four banks; NAB and Westpac slipped 0.1% and 0.3% respectively, while Commonwealth Bank was flat and ANZ eked out a 0.1% improvement.

The Australian futures market points to a 0.04% fall today.

Overseas Markets

European sharemarkets were mostly weaker on Friday, as bond yields improved. Daimler slid 1.9% after French rival Renault sold its entire stake in the German car maker at a discount, while BMW gave up 1.3% after the company announced its 2020 operating profit fell in response to the COVID-19 pandemic, despite a solid rebound in second-half sales. Industrials heavyweights Eiffage (+1.2%), Veolia Environnement (+1.1%) and Vinci (+2.0%) all closed higher, while in the Financials space, Barclays strengthened 3.7% and supermarket giant Tesco added 1.8%. By the close of trade, the STOXX Europe 600 fell 0.3% and the German DAX lost 0.5%, however, the UK FTSE 100 bucked the trend to post a 0.4% gain.

US sharemarkets were mixed on Friday, as higher bond yields boosted Financials stocks but led Technology names lower. Boeing strengthened 6.8% following a report the company had received a new order for 24 737 MAX airplanes, with a possible option for up to 60 additional planes. Technology heavyweights Alphabet (-2.5%), Amazon (-0.8%), Apple (-0.9%), Facebook (-2.0%), Microsoft (-0.6%) and Spotify (-2.5%) all ended the session down. The Dow Jones gained 0.9% and the S&P 500 added 0.1% as both indexes posted record highs, however, the NASDAQ gave up 0.6%.

CNIS Perspective

SPACs (special purpose acquisition companies) are running red hot on Wall Street, since the ‘blank-check funds’ can raise equity quickly and remotely. Nearly 500 SPACs have raised approximately US$156 billion over the past year according to SPAC Research, with January hitting a monthly record of nearly US$26 billion. There seems no end to the candidates of businesses lining up to sell themselves to SPACs to bypass the more onerous process of an initial public offering (IPO). Some are thriving, others not so much.

In a typical SPAC, a ‘sponsor’, the person putting up the initial capital, often Wall Street executives and celebrities, invests a nominal amount in return for a 20% stake in the business, so long as it finds a target company and completes a merger, regardless of how well the company performs after the merger. This is not a pay for performance, it is pay before performance. Uniquely, the ‘sponsor’ does not have a fiduciary duty to the investors in the acquired company.

Some SPAC companies could never bear the scrutiny that comes with a traditional IPO process, as they must show potential investors its prior financial records. Therefore, they are not allowed to make projections about earnings because regulators have long worried that companies could mislead investors with unrealistic forecasts. However, in a SPAC transaction, which is a merger instead of a listing, companies can publish their own financial projections, many of which will prove to be inflated since many companies merging with SPACs have no earnings.

SPACs are not new and generally considered a shady corner of the financial world. Whilst some SPACs are investor friendly and have taken some great companies to the public market, it is important that they are heavily scrutinised and motives of the ‘sponsors’ understood.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.