Morning Market Update - 15 March 2022

Cutcher & Neale

14 March 2022

17 July 2023

minutes

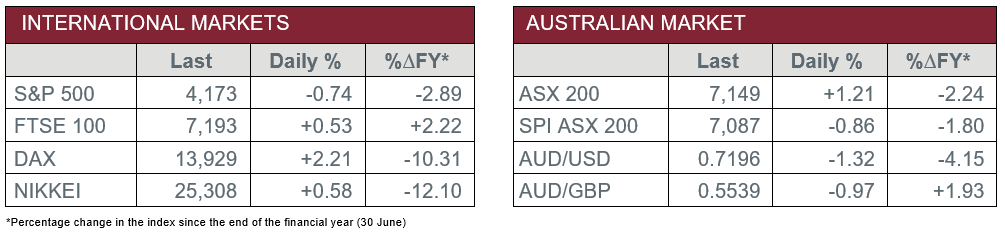

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – RBA Board Meeting Minutes

- Tuesday – UK – Unemployment Rate

- Wednesday – US – Retail Sales

- Wednesday – US – Federal Reserve Meeting

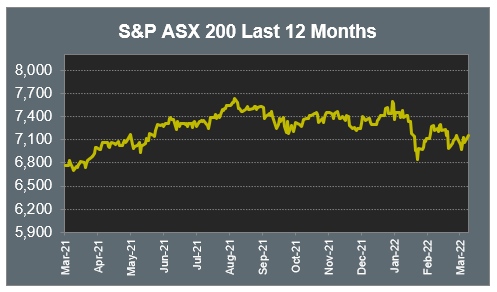

Australian Market

The Australian sharemarket lifted 1.2% yesterday, as the Financials and Health Care sectors led a broad-based rally.

Given increased inflation and higher interest rates are set to weigh on growth stocks, investors moved towards companies with a more defensive nature, including the banks. The Financials sector added 2.5%, as NAB rose 1.5%, while Commonwealth Bank, Westpac and ANZ all gained between 2.5% and 2.8%. Fund managers lost ground; Magellan Financial Group experienced further outflows and lost 1.4%, while Australian Ethical Investment dropped 2.0%.

CSL continued its recent run of strength to add a further 2.6%, which aided the Health Care sector to a 2.2% gain. Among the other health care providers, Australian Clinical Labs added 2.9%, Ramsay Health Care lifted 1.6% and ResMed closed the session 0.3% higher.

The Materials was the main laggard yesterday. Fortescue Metals led the losses, down 1.0%, while BHP and Rio Tinto shed 0.7% and 0.5% respectively. Gold miners were mixed; Northern Star Resources conceded 0.4%, while Evolution Mining added 1.1%.

The Australian futures market points to a 0.86% decline today.

Overseas Markets

European sharemarkets finished higher overnight, with mixed performances experienced among the sectors. The Financials sector increased; Deutsche Bank added 8.0%, ING Groep lifted 4.4% and BNP Paribas rose 4.0%. Automaker stocks also lifted, as Volkswagen jumped 4.4% after the company doubled operating profits, and BMW closed the session 2.8% higher. By the close of trade, the STOXX Europe 600 added 1.2% and the UK’s FTSE 100 lifted 0.5%, while the German DAX rose 2.2%.

US sharemarkets finished lower on Monday, with the Financials sector among the few to finish in positive territory. The Information Technology sector lost ground, as investors prepare for an increase in interest rates; Alphabet dropped 2.9% and Microsoft slipped 1.3%. The Energy sector declined after the price of oil slipped, as ConocoPhillips lost 1.9% and Chevron finished the session 2.4% lower. By the close of trade, the S&P 500 lost 0.7% and the NASDAQ declined 2.0%, while the Dow Jones ended the session relatively flat.

CNIS Perspective

Just when we thought supply chains out of China were beginning to get back on their feet following nearly two years of disruption, a halt to the recovering supply constraints looks to be on the cards.

China has placed the city of Shenzhen into lockdown for at least a week, as COVID cases are reportedly at two-year highs.

The lockdown will be China’s largest since early 2020. While most other countries seem to be taking a ‘live with the virus’ approach, Beijing is prioritising COVID containment over the economy.

Shenzhen itself is a global manufacturing powerhouse; the city accounts for 11% of Chinese GDP, roughly the same output as Spain and South Korea, while it is also home to China’s second largest port.

Some of the world’s biggest manufacturing plants are affected in the lockdown, with Apple, Toyota, Huawei, Tencent and the world’s second largest electric vehicle manufacturer BYD, all likely to temporarily halt operations.

The cost of lockdowns for China is likely to be significant, with the potential for GDP to stall this quarter, making it difficult to meet their target 5.5% GDP growth this year, less than two weeks after the target was announced.

Depending on the timeframe of this lockdown, the rest of the world may have to expect a return to slower supply chains and further inflationary pressures, unless China gives up on their containment policy.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.