Morning Market Update - 16 August 2021

Cutcher & Neale

15 August 2021

17 July 2023

minutes

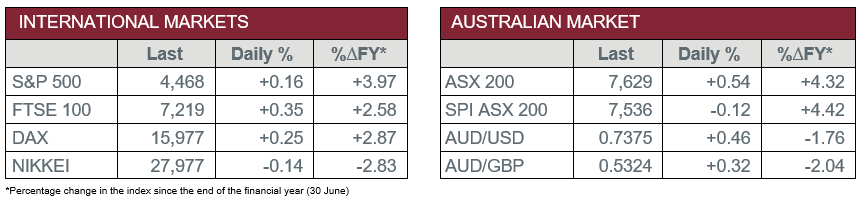

Pre-Open Data

Key Data for the Week

- Monday – CHINA – Industrial Production

- Tuesday – UK – ILO Unemployment Rate

- Tuesday – EUR – Gross Domestic Product

- Tuesday – US – Retail Sales

- Wednesday – EUR – Consumer Price Index

- Wednesday – AUS – Wage Price Index

- Thursday – AUS – Unemployment Rate

- Thursday – US – Initial Jobless Claims

- Friday – UK – Retail Sales

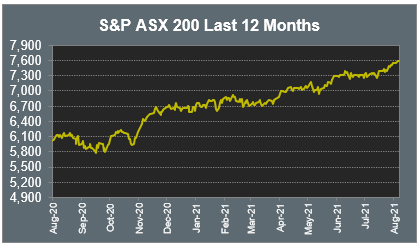

Australian Market

The Australian sharemarket advanced 0.5% on Friday, as all sectors except Materials improved. The Health Care sector led the gains, up 1.9%, boosted by biotechnology heavyweight CSL, which gained 2.4%.

The Consumer Discretionary sector was among the top improvers, up 1.2%. JB Hi-Fi gained 1.2%, Super Retail Group, which owns Rebel Sport, Macpac, BCF and Supercheap Auto, added 1.0%, while Wesfarmers closed up 0.9%. However, Baby Bunting gave up 4.5% despite reporting improvements in annual sales, online growth, profits and dividends.

All the major banks except Commonwealth Bank closed higher. Westpac and NAB both lifted 1.6% and ANZ rose 0.6%, while Commonwealth Bank slid 1.7%. Fund managers were stronger; Challenger added 2.4% and Magellan Financial Group gained 1.7%, while Australian Ethical Investment closed up 0.9%.

The Materials sector was the weakest performer, following a fall in the iron ore price. Mining heavyweights Fortescue Metals and BHP lost 1.0% and 0.3% respectively, however, Rio Tinto eked out a 0.1% gain. Gold miners were mixed; Northern Star Resources rose 0.4%, while Newcrest Mining and Evolution Mining slipped 0.1% and 0.3% respectively.

The Australian futures point to a 0.12% fall today.

Overseas Markets

European sharemarkets lifted on Friday to post its fourth consecutive week of gains. Banking stocks were weaker; Credit Suisse lost 0.8%, while Lloyds Bank and HSBC fell 0.7% and 0.1% respectively. However, Barclays Bank bucked the trend to gain 0.5%. Sportswear company Adidas closed up 2.3% following an announcement that the company is selling Reebok to Authentic Brands Group for up to €2.1 billion.

By the close of trade, the broad based STOXX Europe 600 lifted 0.2% and the German DAX rose 0.3%, while the UK FTSE 100 closed up 0.4%.

US sharemarkets also improved on Friday. Financial services stocks were stronger; PagSeguro Digital gained 3.0% and Visa added 0.4%, while MasterCard and PayPal lifted 0.2% and 0.1% respectively. The Health Care sector rose 0.6%; UnitedHealth Group rose 0.9% and Bristol-Myers Squibb advanced 0.8%, while Johnson & Johnson posted a 0.6% gain and Danaher Corporation lifted 0.5%.

By the close of trade, the Dow Jones and NASDAQ were both relatively flat, while the S&P 500 rose 0.2%.

CNIS Perspective

A UN report released last week issued a red alert for global warming during a Northern Hemisphere summer of astonishing climate extremes. The report is incredibly clear that the climate is changing, and the reason is because humans have been pumping greenhouse gases into the atmosphere, removing any prior debate and doubt. It goes on to say that even if we cut all emissions tomorrow, there is still going to be extreme weather conditions and rising temperatures for the next three decades.

The reason why this report’s language is unequivocal is due to the dramatic increase in data and improvements in climate science and climate modelling that clearly links climate change to human created emissions.

Using financial markets to help solve some issues of global warming is gathering pace, as investors demand transparency around carbon risk, with shareholders caring about these issues more than ever. The questions being asked include how productive corporations are being with their carbon emissions. The greater the carbon output and therefore greater risk, demands higher expected investor returns. Gaining better measurement and management of emissions and emissions data is paramount to the evolution of carbon trading and helping reduce carbon output.

Of course, this greater emphasis by the private sector alone is far from enough. Governments need to provide policy that can steer us away from future generations coping with extreme weather, droughts, bushfires, rising seas and heat waves, which are a reality that we are already living with.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.