Morning Market Update - 17 March 2021

Cutcher & Neale

16 March 2021

17 July 2023

minutes

Pre-Open Data

.jpg?width=958&name=1(1).jpg)

Key Data for the Week

- Tuesday – US – Retail Sales fell 3.0% in February, compared to a 7.6% rise in January.

- Wednesday – EUR – Consumer Price Index

- Wednesday – US – Fed Interest Rate Decision

.jpg?width=494&name=2(2).jpg)

Australian Market

The Australian sharemarket lifted for a third consecutive day on Tuesday to close up 0.8%. Gains were broad based, with only the Energy and Materials sectors weaker.

The Information Technology sector reversed recent losses to close 3.0% stronger. Artificial intelligence company Appen gained 2.9% and accounting software provider Xero jumped 4.0%. Buy-now-pay-later providers also enjoyed strong gains; Afterpay and Zip Co both rose 3.1%, while Sezzle added 3.9%.

The Materials sector lost 0.7% due to continued weakness in iron ore prices. BHP and Rio Tinto gave up 2.2% and 1.1% respectively, while Fortescue Metals bucked the trend to close 0.7% higher. However, goldminers were stronger; Evolution Mining gained 2.5% and Newcrest Mining rose 0.2%.

The Health Care sector was a top performer, closing up 2.4%. Sonic Healthcare added 3.1% and biotechnology giant CSL gained 2.3%, while Ramsay Health Care and Cochlear lifted 2.1% and 1.8% respectively.

REITs also outperformed yesterday. Commercial property company Goodman Group lifted 3.4% and Cromwell Property Group gained 3.1%, while Aventus Group and GPT Group added 2.8% and 1.6% respectively.

The Australian futures market points to a 0.44% fall today.

Overseas Markets

European sharemarkets advanced on Tuesday, as the broad based STOXX Europe 600 gained 0.9%. The automakers sector climbed 2.1%, its highest level since June 2018. Volkswagen AG led the gains, closing up 6.7% after the company announced it is confident that cost cuts will improve profit margins. Porsche SE added 4.9% and Bayerische Motoren Werke AG (BMW) rose 3.5%. Pharmaceutical company AstraZeneca closed 3.2% higher, despite the suspension of its COVID-19 vaccine in various European countries.

US sharemarkets were mixed overnight, as investors awaited the outcomes from the Federal Reserve’s two-day policy meeting. The Information Technology sector was a strong performer, up 0.8%. Facebook gained 2.0%, while Apple and Alphabet both lifted 1.3%. By the close of trade, the Dow Jones fell 0.4% and the S&P 500 slipped 0.2%, while the NASDAQ closed up 0.1%.

CNIS Perspective

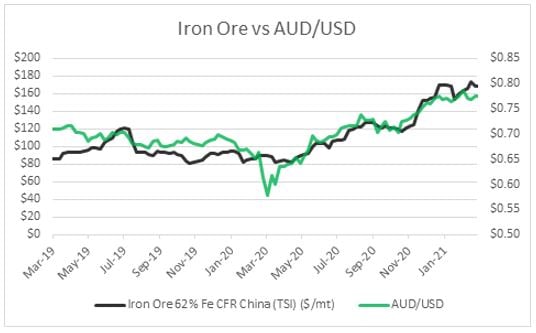

Iron ore has been a standout performer in commodity markets over the past 12 months, as a raft of supply and demand factors pushed the price of the raw material to a 10 year high in early March and dragged the Australian Dollar higher along with it.

The rally has been mainly driven by China’s industrial heavy COVID related stimulus program, and a significant reduction in the supply out of Brazil.

However, these price supporting factors won’t last forever, and change may be on the horizon. Brazilian miners are returning to full production and recent data shows China’s stimulus rollout is likely to ease later this year, at the same time Chinese port stockpiles are on the rise.

In addition, China is working on new policy measures to clean up its steelmaking industry, announcing curbs on steel production to limit pollution, as it aims for peak emissions by 2030, before hitting ‘carbon neutrality’ by 2060.

With Australia’s currency highly influenced by the price of the raw material, if a retracement in the iron ore price from lofty highs eventuates, expect a depreciation of the Australian Dollar to follow.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.