Morning Market Update - 18 March 2021

Cutcher & Neale

17 March 2021

17 July 2023

minutes

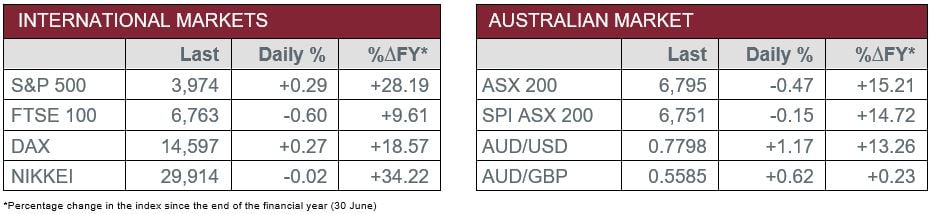

Pre-Open Data

Key Data for the Week

- Wednesday – EUR – Consumer Price Index remained at 0.2% in February and up 0.9% year-on-year.

- Wednesday – US – Fed Interest Rate Decision – The US Federal Reserve decided to keep rates unchanged at 0.25%.

- Thursday – AUS – Unemployment Rate

- Thursday – UK – BoE Interest Rate Decision

Australian Market

The Australian sharemarket gave up its three-day winning streak to close down 0.5% on Wednesday. Losses were broad based, with the Materials and Energy sectors the weakest performers, both down over 1.0%.

All the major banks, except NAB, closed weaker; ANZ and Westpac slipped 0.7% and 0.2% respectively, while NAB closed flat and Commonwealth Bank fell 0.1% despite announcing plans to offer a new buy-now-pay-later service to its customers. From mid-2021, customers will be able to split transactions between $100-$1000 into four payments, while the bank will only charge businesses its standard fee for the service.

Weaker iron ore prices continue to weigh on the Materials sector. BHP and Rio Tinto lost 1.6% and 0.9% respectively, while Fortescue Metals gave up 0.6%. The Energy sector also underperformed; Oil Search fell 2.5% and Woodside Petroleum closed down 0.9%, while Santos lost 0.8%.

The Consumer Discretionary sector lifted 0.1%; Wesfarmers gained 0.2% and Super Retail Group, owner of brands such as Rebel Sport, Macpac and BCF, added 1.1%, while furniture and homewares retailer Temple & Webster jumped 4.2%.

The Australian futures market points to a 0.15% fall today.

Overseas Markets

European sharemarkets eased overnight, as the broad based STOXX Europe 600 fell 0.5%. Renewable energy stocks closed weaker; Vesta Wind Systems gave up 5.8% and Siemens Gamesa fell 4.0%. Banking stocks were stronger; HSBC lifted 1.8% and Deutsche Bank gained 1.0%, while Lloyds Bank added 0.6%.

US sharemarkets advanced on Wednesday after the US Federal Reserve stated an intention to keep interest rates close to zero until 2023. The Information Technology sector closed weaker; Apple and Spotify lost 0.7% and 0.5% respectively, while Microsoft slipped 0.3%. However, Facebook and Amazon bucked the trend to close up 1.7% and 1.4% respectively. By the close of trade, the S&P 500 lifted 0.3% and the NASDAQ added 0.4%, while the Dow Jones gained 0.6%.

CNIS Perspective

July marks the 100th anniversary of the Communist Party of China (CCP) and last week the CCP announced its 14th Five Year Plan (FYP) for 2021- 25.

The FYP is thousands of pages long, touching on a wide range of topics from the status of previous goals, to expanding on major and minor goals for the next five years.

Some of the major goals cover topics like GDP ranges, urban population growth, an unemployment rate target, share of digital economy, green development (carbon emissions), life expectancy and retirement age and population growth (birth rates).

There are some key issues here for investors, which we will no doubt address when constructing our portfolios.

- Technology will be a winner. China is committed to a digital economy, with a suite of government endorsed technologies that will drive innovation and demand in the future. China has a desire to become a modernised country and technology will play a major role in achieving this.

- Healthcare and Education will be winners. Increasing urbanisation, fertility and life expectancy all play into the growth of China’s healthcare capabilities and education, as more children are born into city clusters. Healthcare and education will receive significant government infrastructure funding to ensure they cater for growing demand.

- Green energy should also be a beneficiary. China’s focus on carbon emission reduction implies a growth for green energy and cleaner ways to produce materials in the future.

The FYP addressed many topics and clearly there will be winners as their integration unfolds.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.