Morning Market Update - 19 March 2021

Cutcher & Neale

18 March 2021

17 July 2023

minutes

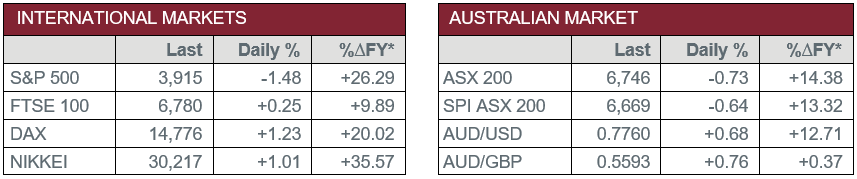

Pre-Open Data

Key Data for the Week

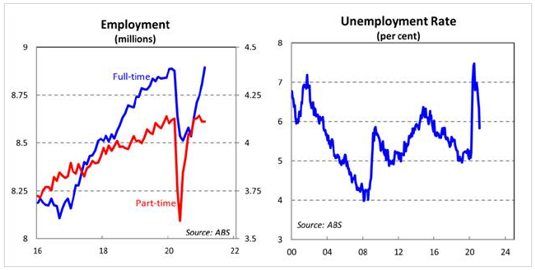

- Thursday – AUS – Unemployment Rate fell to an 11-month low of 5.8% in February, as 88,700 jobs were added. Employment is just 0.2% below its pre-COVID level.

- Thursday – UK – BoE Interest Rate Decision – The BoE kept policy rates unchanged.

- Friday – AUS – Retail Sales

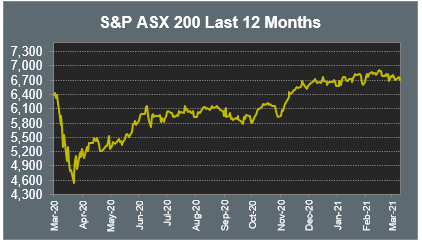

Australian Market

The Australian sharemarket fell 0.7% yesterday, as the Health Care, Industrials, Information Technology, REITs and Utilities sectors all lost over 1%.

The Financials sector also underperformed, with Commonwealth Bank the weakest performer, down 1.6%, while Westpac and NAB both fell 0.9% and ANZ lost 0.8%. Westpac announced it will sell its lenders mortgage insurance business to Arch Capital and outsource the service to the company on an exclusive 10-year supply agreement. Fund manager Australian Ethical Investment outperformed, up 2.2%.

Mining heavyweights BHP, Fortescue Metals and Rio Tinto all lost between 0.5% and 0.9% to lead the Materials sector lower. Goldminers traded higher following a rise in the price of the precious metal; Newcrest Mining lifted 3.7% and Norther Star Resources added 3.2%.

The Health Care sector was led lower by CSL, Cochlear and Ramsay Health Care, which all closed down between 1.9% and 2.6%.

The Consumer Discretionary sector bucked the trend; Super Retail Group lifted 3.9%, Harvey Norman added 1.9% and Kogan rose 1.1%.

The Australian futures market points to a 0.64% fall today, driven by weaker US markets.

Overseas Markets

European sharemarkets were higher on Thursday. Automakers led Germany’s DAX higher as Mercedes-Benz owner, Daimler AG added 4.2%. Financials also outperformed as Deutsche Bank lifted 4.9%, Credit Suisse rose 2.5% and Barclays added 1.4%. UK online real estate company Rightmove added 2.2%. By the close of trade, the broad based STOXX Europe 600 added 0.4%.

US sharemarkets closed lower overnight as an increase in bond yields raised concerned on valuations. Tesla slumped 6.9%, while technology heavyweights Apple, Alphabet and Microsoft all fell between 2.7% and 3.4%. Cloud computing and cybersecurity companies CrowdStrike and Fortinet also underperformed, down 8.6% and 5.3% respectively. Energy stocks were the weakest performers; Chevron slipped 3.6% as the oil price fell, while Enphase Energy and SolarEdge Technology lost 9.4% and 8.6% respectively.

By the close of trade, the Dow Jones fell 0.5%, the S&P 500 lost 1.5% and the NASDAQ slumped 3.0%.

CNIS Perspective

Data released yesterday has shown a sharp drop in Australia’s unemployment rate, falling to 5.8% in February, down from 6.3% in January. The decline was much stronger than expected and comes just days before the Federal Government removes the JobKeeper subsidy program on 28 March.

There have been calls for the Federal Government to extend JobKeeper for certain sectors and industries, however, Prime Minister Scott Morrison has stated "JobKeeper must come to an end. It has done its job".

This certainly appears to be the case. The economy has recovered almost all the jobs lost over the February-May period last year during the height of the pandemic and amidst the national lockdown.

The good news continues to build with other encouraging economic data, including a strong bounce back in business and consumer confidence as well as retail sales. This comes as vaccine rollouts start and fewer restrictions are in place for businesses.

Some disruption to jobs over the next few months is likely, however, the unemployment rate should still end this year lower than where it started.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.