Morning Market Update - 19 May 2022

Cutcher & Neale

18 May 2022

17 July 2023

minutes

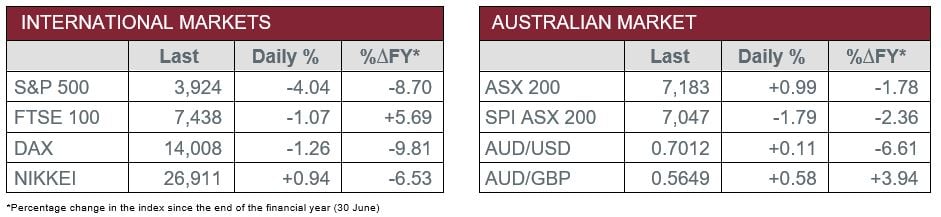

Pre-Open Data

Key Data for the Week

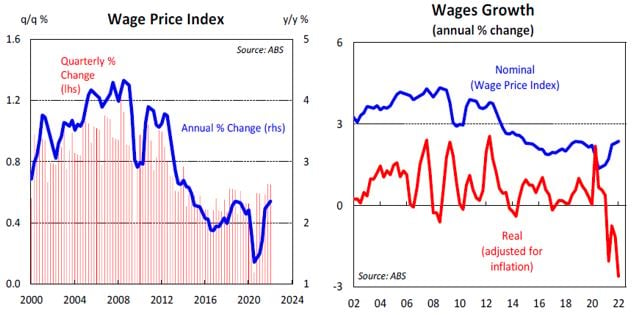

- Wednesday – AUS – Wage Price Index rose by 0.7% over the March quarter, which represented annual growth of 2.4%.

- Wednesday – UK – Consumer Price Index increased by 9.0% in the 12 months to April, up from 7.0% in March.

- Thursday – AUS – Unemployment Rate

Australian Market

The Australian sharemarket gained ground on Wednesday, up 1.0%, driven higher by the Materials (2.5%) sector. BHP (3.2%), Fortescue Metals Group (2.0%) and Rio Tinto (2.1%) all advanced, after the price of iron ore jumped 2.2% on Tuesday night.

In economic news, weaker than expected wages growth data was interpreted by some investors to mean a reduction in the likelihood of an aggressive rate hike by the Reserve Bank of Australia in June, which seemed to support the session’s strong performance.

By the close of trade, 9 out of 11 sectors were in the green, the main detractor being the Consumer Staples (-1.0%) sector, which was weighed down by supermarket giants Woolworths (-1.1%) and Coles (-1.4%). Meanwhile, the Information Technology sector recovered from recent weakness, ahead 1.9%, led by Megaport (4.1%), Block (3.2%) and Xero (2.3%).

Other notable performers in yesterday’s session included Paladin Energy (5.2%), Flight Centre (4.7%) and Seven Group Holdings (4.5%).

The Australian futures market points to a 1.79% decline today, following a weak lead from international markets overnight.

Overseas Markets

European sharemarkets weakened on Wednesday, after concerns around inflation were reignited by the strongest UK Consumer Price Index data seen in 40 years. Unsurprisingly, the Information Technology sector fared the worst, broadly down 2.7%, alongside the Materials sector, which lost 1.2%. By the close of trade, the STOXX Europe 600 and UK FTSE 100 both fell 1.1%, while the German DAX gave up 1.3%.

US sharemarkets sank on Wednesday, as the brief rally in growth related stocks faded amid economic concerns around inflation. Retail heavyweight Target reinforced inflation anxiety, after it reported 1Q 2022 profit had halved due to higher fuel and freight costs. The company’s share price fell 24.9%, its largest fall since 1987. Meanwhile, Walmart reduced its profit forecast on Tuesday and lost 11.4%, before its share price fell a further 6.8% yesterday. By the close of trade all sectors were in the red, led by Consumer Discretionary (-6.6%), Consumer Staples (-6.4%) and Information Technology (-4.7%). The Dow Jones conceded 3.6%, the S&P 500 fell 4.0% and the NASDAQ lost 4.7%.

CNIS Perspective

Wages growth is a key factor in the inflation story, so it was a relief that the March quarter Wage Price Index (WPI) rose by 0.7%, rather than the expected 0.8%.

In annual terms the WPI has risen 2.4%, which is the fastest pace since the December quarter of 2014.

Interestingly, wages growth rose less than inflation, meaning households have experienced a reduction in purchasing power. Real wages fell 2.6% over the year to the March quarter of 2022, which is the largest fall since September quarter of 2000, following the introduction of the GST.

While the RBA has stressed the importance of getting “back to business as usual”, yesterday’s softer wages growth data may slow the pace of interest rate normalisation back to 0.25% at next month’s meeting, down from 0.40%, which was widely expected.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.