Morning Market Update - 21 October 2020

Cutcher & Neale

20 October 2020

17 July 2023

minutes

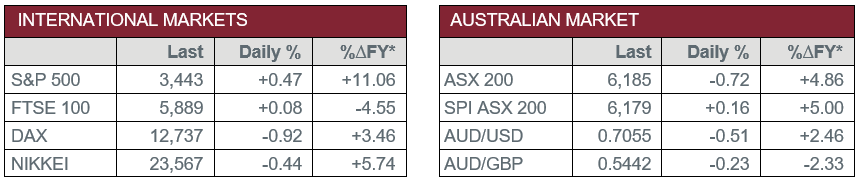

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – RBA Meeting Minutes – The RBA hinted they may ease monetary policy as soon as 3 November. The RBA believes the easing of monetary policy would have ‘traction’ now that restrictions are being lifted.

- Wednesday – AUS – Retail Sales

- Wednesday – UK – Consumer Price Index

Australian Market

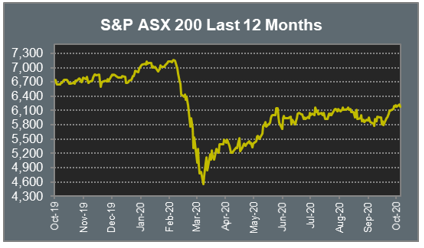

The Australian sharemarket closed 0.7% lower on Tuesday, with losses broad based. Financials, Materials and Energy were the weakest performers, while Technology was the only sector that closed stronger.

The Materials sector was dragged lower by the mining heavyweights. BHP slumped 1.6% despite the release of the company’s September quarter production update, which saw a 7.2% rise in iron ore production during the first quarter. Rio Tinto lost 1.5%, while Fortescue Metals bucked the trend to add 0.6%. Goldminers also saw losses yesterday; Evolution Mining fell 2.2%, while Saracen Mineral and Northern Star slipped 0.5% and 0.3% respectively.

The Financials sector also underperformed, weighed down by losses among the big banks. Westpac slipped 1.4% and Commonwealth Bank fell 1.2%, while NAB and ANZ lost 1.1% and 1.0% respectively.

Information Technology closed higher yesterday, with the gains largely due to Afterpay’s strong performance. The buy-now-pay-later provider jumped 4.5% after the company announced it had signed an arrangement with Westpac that allows Afterpay to link their services with Westpac savings and transaction accounts. Zip Co announced that consumers will now be able to pay via Zip at any store that accepts Visa cards. Zip Co was up for most of the day, however, finished 1.4% lower.

The Australian futures market points to a 0.16% rise today.

Overseas Markets

European sharemarkets closed mostly lower overnight as Brexit negotiations continued and further restrictions were imposed in Italy, Spain and the UK. The Financials sector outperformed; Barclays added 0.9% and Lloyds Bank rose 0.3%, while UBS lifted 2.7% after the company reported a 99% jump in quarterly profit. Travel and leisure stocks also enjoyed gains; International Airlines Group added 6.7% and easyJet jumped 5.7%, while Ryanair rose 1.3%. The broad based STOXX Europe 600 fell 0.4% and the German DAX slipped 0.9%, however, the UK FTSE 100 added 0.1%.

US sharemarkets rose on Tuesday amid hopes of further US stimulus packages aimed at relieving some of the economic shock from COVID-19. The Financials sector closed higher; Bank of America added 1.8%, Citigroup lifted 1.5% and Morgan Stanley rose 1.0%. Financial services also saw gains; PayPal and Visa gained 1.0% and 0.4% respectively. The Information Technology sector also closed higher; Fortinet rose 2.9% and Facebook added 2.4%, while Alphabet gained 1.4% despite the US Department of Justice’s decision to issue Google with an antitrust lawsuit. By the close of trade, the NASDAQ added 0.3%, the Dow Jones rose 0.4% and the S&P 500 gained 0.5%.

CNIS Perspective

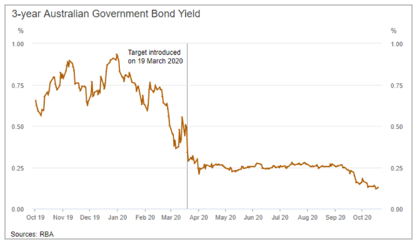

If you would like to see a sure sign that we are heading for even lower interest rates, look no further than the movement in the Australian 3-year Government Bond yield.

As a stimulatory measure to help lower funding costs across the economy, the RBA announced it would target purchases of 3-year risk free Government Bonds at 0.25% in March this year. While the RBA’s influence reduced this yield very abruptly, market forces over the past six weeks have been consistently pushing yields even lower than the target.

Despite the RBA’s target of 0.25%, the current yield is now sitting at just 0.125%. This suggests the market is expecting a further easing of RBA policy, with the ASX rate indicator pricing in an 82% change we see the Official Cash Rate lowered on Melbourne Cup day.

Ramifications of fixed income yields at these levels may mean we see price rises in riskier based assets, which at this point, is not something the RBA has high on their agenda to address, until improved employment levels and inflation kicks back into gear.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.