Morning Market Update - 22 July 2022

Cutcher & Neale

21 July 2022

17 July 2023

minutes

Pre-Open Data

Key Data for the Week

- Thursday – EUR – ECB Policy Decision – The ECB raised rates by 0.5%, the largest hike since 2000, and the first time since 2011.

- Friday – US – Markit Manufacturing

- Friday – UK – Retail Sales

Australian Market

The Australian sharemarket finished 0.5% higher on Thursday, after an afternoon rally in the Information Technology (3.2%) and Health Care (1.6%) sectors offset losses in the Energy (-2.8%) and REITs (-1.0%) sectors. By the close of trade, seven out of eleven industry sectors advanced.

The Information Technology sector has recovered modestly over the last month, up ~19.9%, however, still remains down ~14.2% year on year. Notable contributors in yesterday’s session included WiseTech Global (3.6%), Xero (3.3%) and Block Inc (6.7%). In company news, Link Administration Holdings leapt 12.6%, after news its management recommended the acceptance of a revised takeover bid of $4.81 per share by Dye & Durham. Additionally, Zip Co surged 16.5%, after it reported a 27% uplift in revenues, 20% increase in transaction volumes and 64% spike in customers to around twelve million.

Meanwhile, the Energy sector suffered from weaker global oil prices on Wednesday night. Sector heavyweight Woodside Energy posted its first quarterly update since its merger with BHP. The company reported revenue jumped by 43.6% over the quarter, to be up 159.1% over the year, which was driven by a 60% increase in production. However, it seemed market participants had already mostly priced-in such strong earnings results, given booming oil and gas prices over the quarter, as its share price fell 4.4%.

The Financials sector outperformed the broader market, up 1.0%, after all major banks advanced. ANZ (2.2%) led gains, followed by Commonwealth Bank (1.7%), Westpac (1.5%) and NAB, which was flat.

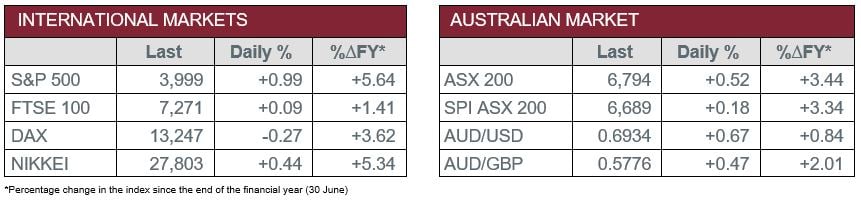

The Australian futures market points to a relatively flat open today, up 0.18%.

Overseas Markets

European sharemarkets were mixed on Thursday, as market participants considered the ramifications of the larger than expected rate hike by the European Central Bank. In other news, Italian Prime Minister Mario Draghi resigned, which was a source of elevated uncertainty in the region. On the other hand, worries around energy supply eased as Russian gas flows resumed into Germany via the Nord Stream pipeline. Meal-kit provider HelloFresh (-14.0%) was the notable detractor in yesterday’s session, as investors continued to digest its recent earnings report, which saw a cut to year end guidance. The company cited inflation, low consumer confidence and the Ukraine war as key headwinds. By the close of trade, the STOXX Europe 600 rose 0.4%, the German DAX lost 0.3% and the UK FTSE 100 was relatively flat, up 0.1%.

US sharemarkets were higher on Thursday, despite mixed earnings results. Nine out of eleven industry sectors advanced, with Energy (-1.7%) and Communication Services (-0.2%) being the only detractors. The Consumer Discretionary (2.3%) sector was the standout performer, boosted by Tesla, which jumped 9.8%, after its quarterly report beat earnings estimates. Amazon was another notable contributor to the sector, up 1.5%. Other company reports included AT&T, which fell 7.6%, after it lowered its full-year free cash flow guidance, alongside United Airlines, which plunged 10.2%, due to lower than expected earnings. By the close of trade, the Dow Jones rose 0.5%, the S&P 500 added 1.0% and the NASDAQ jumped 1.4%.

CNIS Perspective

As we approach the final week of July it is encouraging to see the progress in US equities following the past 6 months of volatility.

Stocks have seen some stability in recent weeks, underpinned by expectations that inflation in the US looks to be stabilising and expectations of a softening in the back half of the year looking likely, as energy and food prices begin to soften.

Additionally, earnings reports from companies released to date have shown greater resilience than expected, with a number of major businesses including Citigroup, Bank of America, Goldman Sachs, Tesla, Netflix and United Health among others, performing strongly and providing optimism across US indices.

Both the S&P 500 and NASDAQ have now both moved above their 50-day moving averages for the first time since April.

This leaves the S&P 500 up 5.6% in July so far, with the heavily sold off NASDAQ recording a 9.7% gain over the same period.

Should you wish to discuss this or any other investment related matter, please contact your Wealth Management Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.