Morning Market Update - 23 October 2020

Cutcher & Neale

22 October 2020

17 July 2023

minutes

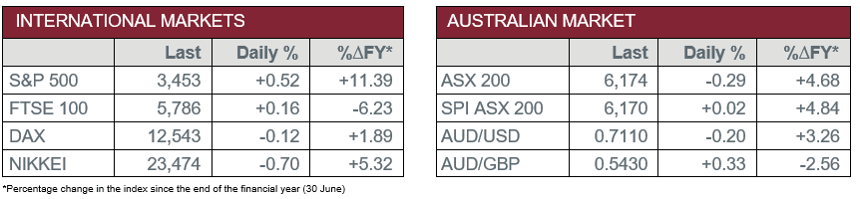

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Thursday – US – Existing Home Sales rose from 5.98 million in August to 6.54 million in September.

- Thursday – US – Initial Jobless Claims beat expectations at 787,000 this week, down from 898,000 the previous week.

- Friday – UK – Retail Sales

- Friday – US – Markit Manufacturing PMI

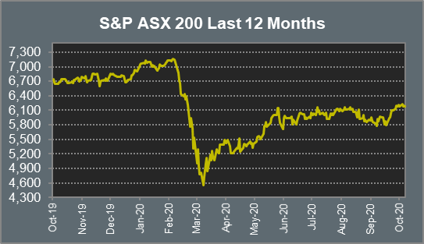

Australian Market

The Australian sharemarket fell 0.3% yesterday, with investors trading cautiously amid allegations of US election interference by Russia and Iran. Consumer Staples, Health Care and Materials were the only sectors to trade higher.

The Energy sector was the weakest performer on Thursday, after a 4% decline in global oil prices occurred overnight. Oil Search slipped 3.7%, while Santos and Woodside Petroleum lost 1.9% and 1.6% respectively, following the release of quarterly production updates. Both Woodside Petroleum and Santos saw a lift in production during the September quarter, however, revenues year-to-date in 2020 have declined on the previous year.

The Financials sector also underperformed, with the big four banks all closing 0.5% lower. Wealth managers also closed weaker; Magellan Financial Group lost 0.7% and Australian Ethical Investment fell 2.8%, while AMP slumped 5.5% following the release of the company’s quarterly Assets Under Management (AUM) balance. AUM for AMP’s Capital division dropped 0.4%, while AUM for the firm’s Australian wealth business saw a slight lift.

The Australian futures market points to a 0.02% rise today.

Overseas Markets

European sharemarkets fell for a fourth consecutive day on Thursday, as the broad based STOXX Europe 600 fell 0.1%. The Travel and Leisure sector was the strongest performer; British train ticketing platform, Trainline, added 3.0%, while International Airlines Group jumped 4.3%. The Financials sector was also higher; Lloyds Bank added 2.8%, while Barclays and HSBC both gained 1.5%.

US sharemarkets rose overnight, with Energy and Financials leading the gains. JP Morgan Chase added 3.5%, while Bank of America and Citigroup gained 3.4% and 2.2% respectively. American telecommunications company, AT&T, jumped 5.8% after the number of wireless subscriber additions exceeded expectations. By the close of trade, the NASDAQ rose 0.2%, while the S&P 500 and the Dow Jones both gained 0.5%.

CNIS Perspective

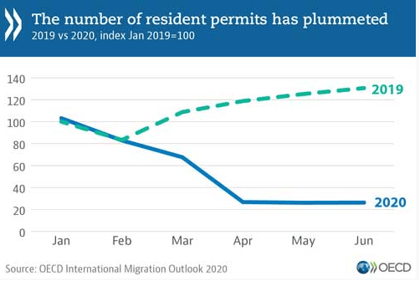

The decision to shut Australia’s borders to prevent COVID-19 spreading has pulled the country into a new reality, where a lower population growth will affect everything from the number of schools that states build, to innovation, house prices and the rate of infrastructure investment, according to an outlook published by Deloitte this week. Their forecast is that the nation’s population will grow by at least 600,000 fewer people in 2022 than was previously estimated.

Australia has relied upon population growth, mainly through migration, over the past 30 years to fuel our economic growth. It is likely this reduction in migrants will weigh on the pace of recovery and accelerate the ‘ageing’ of our population, especially combined with our slumping birthrate. Deloitte noted that the coronavirus ‘hangover’ could see an Australian economy permanently more than 3% smaller than the pre-COVID forecasts, which will have a knock-on effect for many businesses and their growth trajectories.

Australia is not an isolated incidence, with an OECD outlook published this week noting the COVID-19 crisis has had unprecedented consequences on migration flows globally, with the issuances of new visas and permits in the OECD plummeting 46% in the first half of 2020. The OECD is predicting that mobility will not return to previous levels for some time due to weaker labour demand, travel restrictions and widespread remote working and learning.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.