Morning Market Update - 25 August 2021

Cutcher & Neale

24 August 2021

17 July 2023

minutes

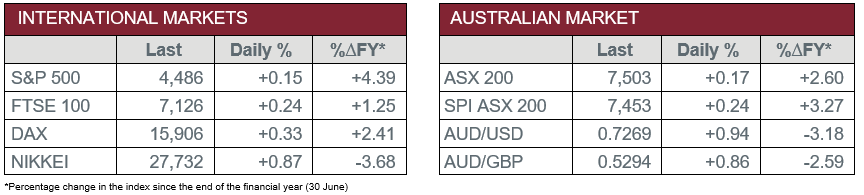

Pre-Open Data

Key Data for the Week

- Tuesday – US – New Home Sales increased 0.1% in July, following three months of consecutive declines.

- Wednesday – AUS – Construction Work Done

Australian Market

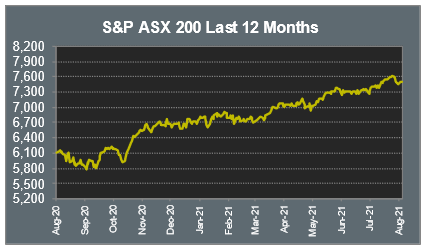

The Australian sharemarket added 0.2% yesterday, as commodity prices increased, and companies continue to release their full-year earnings reports.

The Energy sector benefitted from a reprieve in the price of oil, after it had been weakened for seven consecutive days. As a result, Woodside Petroleum and Santos both added 3.2%, while Beach Energy lifted 3.3%.

The big four banks were relatively unchanged yesterday; Commonwealth Bank shed 0.3%, while Westpac and ANZ lifted 0.5% and 0.3% respectively, and NAB eked out a less than 0.1% gain. Fund manager, Australian Ethical Investment conceded 6.0% during the day’s trade, and is one of the companies set to report earnings today.

Scentre Group, the operator of Westfield shopping centres, was one of the standouts on the market, after it reported a $400 million half-year profit as stores reopened and customers returned after the initial COVID lockdowns. As a result, the company’s share price rose 6.7%

The Australian futures point to a 0.24% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets were relatively flat overnight as COVID-19 concerns outweighed stronger-than-expected economic recovery data from Germany. Travel stocks enjoyed gains following news the Pfizer-BioNTech COVID vaccination had received full FDA approval. As a result, British Airways owner, International Airlines Group, added 2.2% and Lufthansa rose 3.0%, while easyJet gained 5.0%. Commodity based stocks rose throughout the day’s trade; London-listed BHP added 1.3%, while Glencore rose 2.6%.

By the close of trade, UK’s FTSE 100 gained 0.2% and the German DAX added 0.3%, while the STOXX Europe 600 closed relatively flat.

US sharemarkets lifted on Tuesday, although many investors are awaiting Federal Chair, Jerome Powell, to meet with world bank leaders regarding the possibility of tapering of asset purchases and interest rate increases. ‘Big tech’ companies led the NASDAQ higher, as Amazon rose 1.2%, while PayPal and Google’s parent company, Alphabet, both added 0.9%. The US Energy sector also enjoyed gains following an increase in the price of oil; Chevron added 1.2% and ExxonMobil lifted 0.8%.

By the close of trade, the Dow Jones and S&P 500 added 0.1% and 0.2% respectively, while the NASDAQ gained 0.5%.

CNIS Perspective

The extent of the economic damage done by COVID will start to emerge over the next few days.

Today, construction data is due to be released for the June quarter, which is expected to soften from March’s quarterly growth of 2.4%, to a likely rise of only 0.9%. It will be interesting to see just how much government or public construction spending is part of that.

Tomorrow, an important measure of the strength of business investment will be released with capital expenditure data also for the June quarter. Capital expenditure had been rising since late 2020 as confidence of the economic recovery gained momentum. Generous government tax incentives should offset the impact of lockdowns, but by how much?

While on Friday, retails sales figures for the month of July will be released. NSW data will be affected by Sydney’s lockdowns and should at least follow the 1.8% decline of June, as consumer spending dried up.

There probably won’t be too many surprises in the data, which should set the scene for negative GDP growth for the September quarter, at least.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.