Morning Market Update - 27 October 2021

Cutcher & Neale

26 October 2021

17 July 2023

minutes

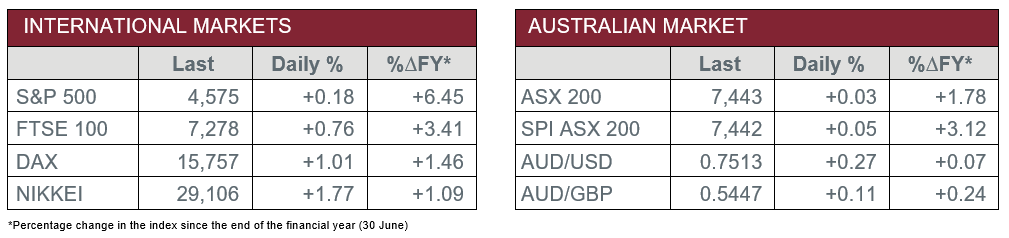

Pre-Open Data

Key Data for the Week

- Tuesday – US – New Home Sales increased 14.0% in September.

- Tuesday – US – Consumer Confidence Index rose to 113.8 in October, up from 109.8 in September.

- Wednesday – AUS – Consumer Price Index

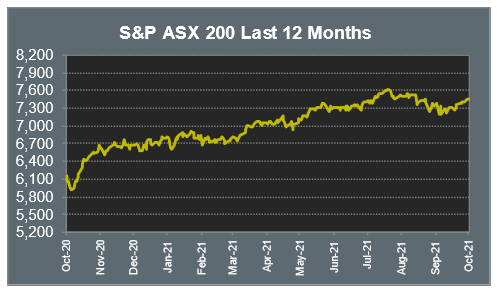

Australian Market

The Australian sharemarket eked out a less than 0.1% gain yesterday, as losses in the Materials and Energy sector overshadowed gains in the Information Technology sector. Investors also seemed cautious ahead of the inflation data due to be released today.

The two casino operators were among the best performers on the market yesterday. Crown Resorts was notified it retained it’s Melbourne casino licence and will be given a ‘two-year grace period’ to correct wrongdoings. As a result, the company’s share price traded 8.7% higher. Star Entertainment also benefited from the news and added 4.3%.

Afterpay lifted the Information Technology sector, as it gained 3.3%. Other buy-now-pay-later providers made gains; Humm Group lifted 2.8% and Zip rose 0.2%. Artificial intelligence provider, Appen, lifted 1.8%, while data-centre operator, NEXTDC, closed the session up 0.9%.

The Financials sector closed the session 0.1% higher. NAB led the gains, up 0.6%, while Westpac and ANZ both lifted 0.3%. Commonwealth Bank made gains early in the trading session, however slipped throughout the day to close 0.3% lower.

The Australian futures market points to a 0.1% rise today, driven by stronger overseas markets.

Overseas Markets

European sharemarkets gained on Tuesday, aided by more up-beat earnings reports. UBS boosted the Financials sector, after the company beat expectations to report a US$2.3 billion profit. Reckitt Benckiser Group, the producer of Lysol cleaning products, rose 5.8% after it beat estimates for third-quarter sales and increased full-year guidance.

By the close of trade, the UK FTSE 100 gained 0.8%, while the German DAX and STOXX Europe 600 rose 1.1% and 0.8% respectively.

US sharemarkets closed higher overnight due to gains in the Information Technology sector. NVIDIA Corp jumped 6.7%, while Amazon closed the session 1.7% higher. However, gains were restricted as Facebook fell 3.9% after Apple’s new privacy changes could weigh on their digital business.

By the close of trade, the NASDAQ added 0.1% and the S&P 500 lifted 0.2%, while the Dow Jones gained less than 0.1%.

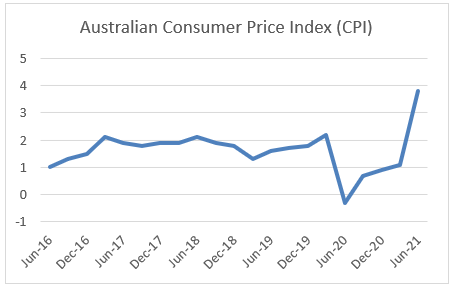

CNIS Perspective

Investors are becoming increasingly cautious that inflationary pressures are potentially more permanent than central banks are alluding to.

Today’s Australian Consumer Price Index (CPI) should provide investors with a clearer image of the months ahead.

Last quarter, CPI rose 0.5%, and a further jump is expected this quarter. This comes as a result of the end of lockdowns and increased consumer activity. Increased transport and soaring house prices are also set to contribute to the rise in prices.

The Reserve Bank of Australia has stated the cash rate won’t rise until 2024, however as prices continue to rise, they may be forced to increase rates earlier than planned.

As seen in the graph, consumer prices have been increasing since the COVID-19 lockdowns, and today’s inflationary data will be the next test for our sharemarket to grapple with.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.