Morning Market Update - 28 April 2021

Cutcher & Neale

27 April 2021

17 July 2023

minutes

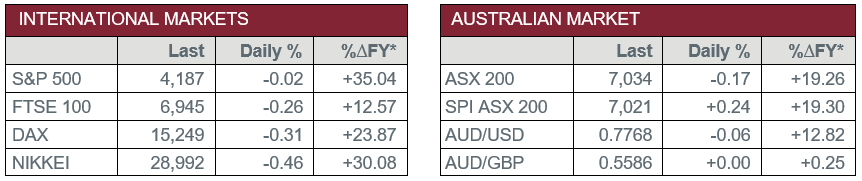

Pre-Open Data

Key Data for the Week

- Tuesday – US – Consumer Confidence rose to 121.7 in April.

- Tuesday – US – Housing Prices increased 0.9%, to be up 12.2% for the year.

- Wednesday – AUS – Consumer Price Index

- Wednesday – US – FOMC Policy Decision

Australian Market

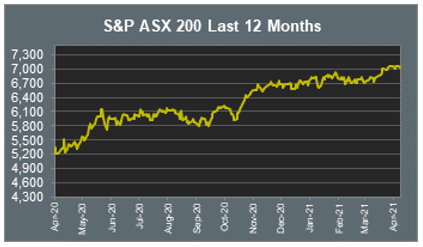

The Australian sharemarket closed 0.2% lower for the second consecutive day, as investors were quick to sell technology stocks with US technology giants set to report their earnings this week. As a result, the Information Technology sector was the worst performer, down 2.5%, with buy-now-pay-later providers Zip and Afterpay falling 6.3% and 5.5% respectively. Artificial Intelligence developer, Appen, also shed 1.8% as the volatility within the US Technology sector flowed through to the Australian sharemarket.

Infant formula producer, the a2 Milk Company fell for its eighth consecutive day as there seems to be no reprieve from the impact that COVID-19 has had on its business. Despite this, there has been speculation that Nestlé, or Mead Johnson may be preparing a takeover.

The travel sector weakened for the second consecutive day, as Sydney Airport fell 1.9%, Flight Centre shed 1.4% and Webjet closed 1.2% lower. This comes as a result of the Australian Government blocking flights from India until the 15th of May as COVID-19 cases in India accelerate.

The price of iron ore climbed to a decade high of US$191 per tonne, which led the Materials sector higher. Gains were seen in BHP and Fortescue Metals, which both closed 1.1% higher, while Rio Tinto added 0.9%.

The Australian futures market points to a 0.24% rise today.

Overseas Markets

European sharemarkets closed slightly lower on Tuesday with all eyes on the US Federal Reserve Meeting this week. Swiss bank, UBS, suffered a 2% loss after reporting a US$774 million hit to 1Q21 earnings as a result of the default of US investment firm, Archegos. The pan-European STOXX 600 index slipped 0.1%.

US sharemarkets were mixed on Tuesday, as investors prepare for technology giants Apple and Facebook to report in the coming day. Microsoft reported their earnings after close of trade, which met analysts’ expectations and beat their profit estimates. The Information Technology sector lagged, as losses in Apple (-0.2%), Alphabet (-0.8%) and Spotify (-1.7%) weighed on the sector.

By the close of trade, the Dow Jones and the S&P 500 closed flat, while the NASDAQ lost 0.3%.

CNIS Perspective

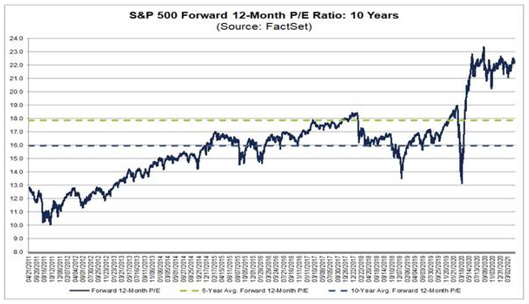

While we have only just lifted the lid on the US Q1 reporting season, the earnings figures being reported are nothing but extraordinary, with the amazing resilience and underlying strength of the US shining through, justifying the current US sharemarket valuation.

With just over a quarter of S&P 500 companies reported earnings to date, companies have reported earnings on average 23.6% above estimates, well above the 5-year average of 6.9%, led mainly by the Financials, Consumer Discretionary and Materials sectors. If 23.6% is the final percentage for the quarter, it will mark the largest earnings surprise percentage reported by the S&P 500 index since FactSet began tracking the metric in 2008.

As the forward 12-month Price/Earnings ratio hovers around 22, well above both the 5-year average (18) and 10-year average (16), justification of this high earnings valuation was needed to maintain the strength of the current sharemarket, and we are now getting that assurance.

Expect earnings to continue to surprise on the upside throughout the remainder of this reporting season, and during 2021, as the US economy roars back into gear.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.