Morning Market Update - 28 October 2021

Cutcher & Neale

27 October 2021

17 July 2023

minutes

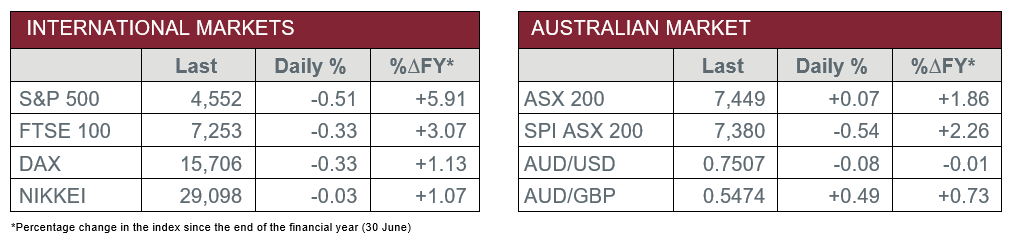

Pre-Open Data

Key Data for the Week

- Wednesday – AUS – Consumer Price Index rose by 0.7% in the September quarter, higher than expected, to be 2.1% higher over the year.

- Thursday – AUS – Trade Price Indices

- Thursday – EUR – Consumer Confidence

- Thursday – UK – Nationwide House Prices

- Thursday – US – Gross Domestic Product

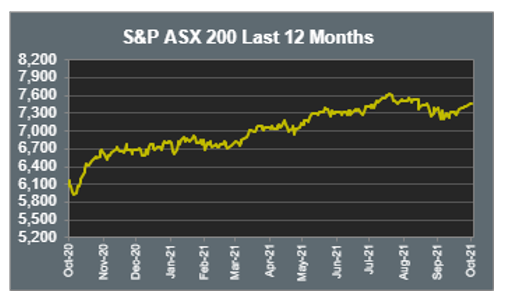

Australian Market

The Australian sharemarket inched ahead 0.1% on Wednesday, as investors digested much anticipated inflation data. While Australia’s headline inflation was in line with expectations, the trimmed mean inflation, the Reserve Bank’s preferred measure of inflation, was stronger than expected. This strengthened the prediction that the Reserve Bank may be forced to raise interest rates sooner, which was reflected in yesterday’s jump in bond yields, particularly the central bank’s targeted Australian 3-year bond.

The Communication Services sector was the strongest performer yesterday, up 1.9%, led by its largest constituent, Telstra (3.2%). This followed two days after it announced its Australian Government endorsed acquisition of Digicel Pacific for US$1.6 billion. Meanwhile, Consumer Staples was the weakest performer, down 2.0%, dragged lower by supermarket heavyweights Woolworths (-3.2%) and Coles (-1.0%). Meanwhile, The A2 Milk Company plummeted 12.0%, after investors learnt management plans to sacrifice profit margins for revenue and address uncertainties around Chinese demand.

The Financials sector performed modestly, up 0.5%, as the big four banks advanced, except for ANZ (-0.1%). NAB (1.4%) led gains, followed by Commonwealth Bank (1.0%) and Westpac (0.6%). Other notable movers in the sector included Australian Ethical Investment (1.4%) and Macquarie Group (-0.6%).

The Australian futures point to a 0.54% decline today.

Overseas Markets

European sharemarkets closed lower on Wednesday, as miners led losses, impacted by China’s intervention to address commodity prices. The STOXX Europe 600 closed 0.4% lower, while the German DAX and UK FTSE both lost 0.3%. London listed Rio Tinto was down 1.4%, while BHP shares dropped 1.3%. Banking stocks also suffered, as Barclays (-1.7%) lost ground alongside the Deutsche Bank (-6.9%), which tumbled after it reported a reduction in revenue from its investment bank department, however, posted better than expected overall quarterly profit.

US sharemarkets were somewhat mixed on Wednesday, after a batch of earnings reports drove market movement. The Dow Jones and S&P 500 lost 0.7% and 0.5% respectively, while the NASDAQ closed flat. Positive earnings results were posted by Technology behemoths Microsoft and Alphabet (Google), which led to a surge in their share prices, as both gained between 4.0-5.0%. Meanwhile, Spotify also reported well as it rose 8.3% overnight. Enphase Energy, designer and developer of solar system technology, surged 24.7%, after it reported revenue had nearly doubled in comparison to last year. On the other hand, investors were disappointed by other company reports, namely: Twitter (-10.8%), Visa (-6.9%), Robinhood (-10.4%), General Motors (-5.4%) and Boeing (-1.5%). Most sectors closed lower, led by Energy which tumbled 2.9%. Communication Services (1.0%) and Consumer Discretionary (0.2%) were the only sectors in the green.

CNIS Perspective

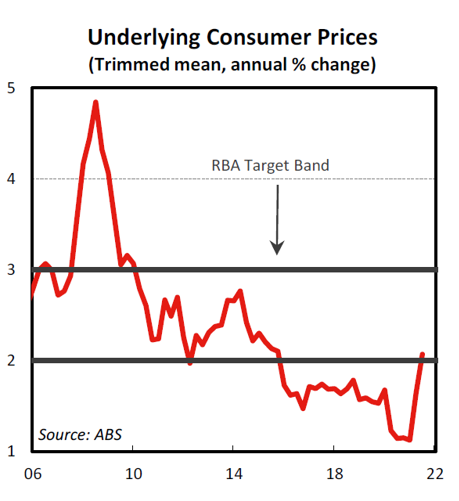

Inflation numbers released yesterday showed Australia isn’t immune to growing inflationary pressures that have impacted other economies around the world.

Underlying inflation rose 0.7% for the quarter, or 2.1% higher over the year.

This was notably stronger than the 0.5% rise that was expected and marks the first time annual underlying inflation was within the RBA’s 2.0–3.0% target band since 2015.

The RBA expected underlying inflation to reach the band much later in 2023.

The underlying inflation rate could move into the upper end of the RBA’s target band by the end of next year, in turn spurring the RBA to lift the cash rate in 2023.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.