Morning Market Update - 30 April 2021

Cutcher & Neale

29 April 2021

17 July 2023

minutes

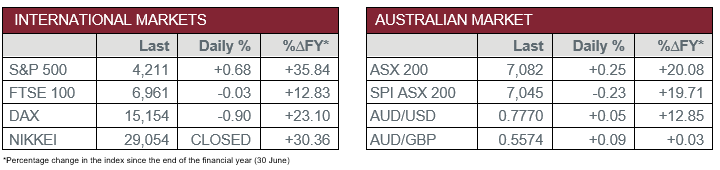

Pre-Open Data

Key Data for the Week

- Friday – US – Gross Domestic Product rose 6.4% on an annualised basis during the March quarter, up 1.6% quarter-on-quarter.

- Friday – US – Initial Jobless Claims fell to 553,000 this week, from 566,000 last week.

Australian Market

The Australian sharemarket gained 0.3% on Thursday in a mixed day of trade. Information Technology was the top performing sector, up 2.2%, while Consumer Staples led the losses, down 1.3%.

The Materials sector lifted 0.8%, with mixed performances among the mining heavyweights; BHP and Rio Tinto both added 0.9%, while Fortescue Metals fell 0.2% after the miner increased its capital costs estimate for the full year from US$3 billion-US$3.4 billion, to US$3.5 billion-$US$3.7 billion.

Gains among buy-now-pay-later providers boosted the Information Technology sector. Afterpay closed up 3.5% after signing New Zealand fintech company Novatti (31.6%) to provide Afterpay branded cards in digital wallets, while Sezzle lifted 3.3% and Zip Co rose 2.5%. Artificial intelligence company Appen gained 2.5%, while accounting software provider Xero added 2.2%.

The Financials sector eased, as the major banks closed weaker. ANZ and NAB both lost 0.5%, while Westpac fell 0.4% and Commonwealth Bank slipped 0.2%. Asset managers outperformed; Australian Ethical Investment jumped 4.3%, while Magellan Financial Group lifted 1.6%.

Woolworths gave up 3.9% after the supermarket giant reported a 0.4% increase in group sales for Q3, however, Australian supermarket sales declined 2.1% after a sales surge during COVID-19 lockdowns.

The Australian futures market points to a 0.23% fall today.

Overseas Markets

European sharemarkets eased overnight, despite banking stocks hitting 14-month highs following strong quarterly results. Europe’s largest bank HSBC gained 2.6%, while Deutsche Bank lifted 3.1%. Automaker stocks led losses; Volkswagen Group shed 3.0%, while BMW gave up 2.4%. By the close of trade, the German DAX fell 0.9% and the STOXX Europe 600 lost 0.3%, while the UK FTSE finished flat.

US sharemarkets advanced on Thursday, as strong economic data boosted investor sentiment. Facebook rallied 7.3% after the company reported stronger than expected earnings, while Alphabet and Spotify both gained 2.1%. The Financials sector was a top performer; Bank of America added 2.7% and JP Morgan Chase lifted 1.9%, while Morgan Stanley and Citigroup rose 1.5% and 1.3% respectively. However, financial services were mixed; Visa closed up 1.5%, while PayPal fell 1.2% and MasterCard gave up 1.7%.

By the close of trade, the Dow Jones and S&P 500 both added 0.7%, while the NASDAQ lifted 0.2%.

CNIS Perspective

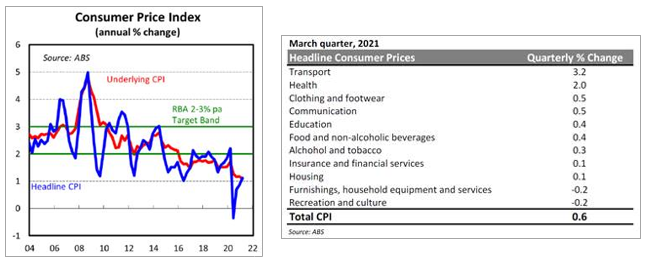

Worries of inflation rising too strong too soon, has been the topic of investor conversation of late, as record levels of stimulus measures, record low interest rates, and the re-opening of economies drive inflationary pressures.

Domestically, inflation data released this week showed a rise of just 0.6% for the March quarter, materially weaker than expected. On an annual growth basis, inflation is at 1.1%, well outside the RBA’s 2-3% target band.

Further, the rise for the quarter was primarily driven by higher fuel prices, as well as an increase in healthcare costs, while all other price measures remained subdued.

The inflation debate is set to continue in the June quarter and likely throughout the remainder of 2021, and we should expect some inflationary pressures, especially given the low base it is coming off.

However, despite all the hype, policymakers expect any spike to be transitory and central banks are holding strong with their mandate to keep interest rates low for the next few years.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.