Morning Market Update - 5 May 2021

Cutcher & Neale

04 May 2021

17 July 2023

minutes

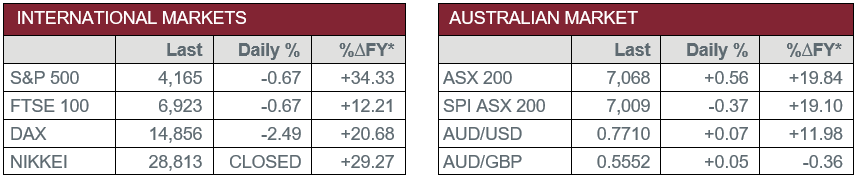

Pre-Open Data

Key Data for the Week

- Tuesday – AUS – Interest Rate Decision – The RBA left the official cash rate unchanged and reiterated their intention for it to remain this way until 2024.

- Tuesday – US – Trade Balance widened to a US$74.4 billion deficit in March.

- Wednesday – AUS – Building Approvals

- Wednesday – EUR – Produce Price Index

Australian Market

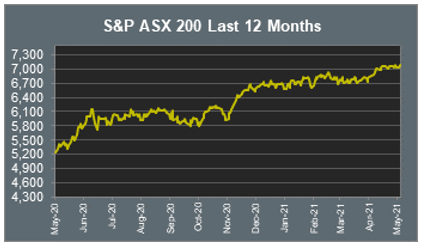

The Australian sharemarket closed 0.6% higher on Tuesday, buoyed by increases in the Materials sector. The price of gold rose by 1.0%, which resulted in gold miners Northern Star Resources and Newcrest Mining gaining 4.2% and 1.5% respectively. An increase in investor confidence in the Materials sector also led to gains in BHP and Rio Tinto, with both adding 2.5%.

Energy shares also enjoyed gains overnight, aided by an increase in the price of oil. Woodside Petroleum lifted 1.5%, Santos added 2.4% and Oil Search increased 2.1%. Emerging uranium miner, Paladin Energy, added an impressive 19.0% to reach a new 52-week high.

The Financials sector closed relatively flat ahead of a key week of earnings announcements. Commonwealth Bank was the best performer of the big four banks, gaining 0.8%, while ANZ and Westpac both conceded 0.9%. NAB eked out a gain of less than 0.1%.

The Information Technology sector weighed on the Australian sharemarket, which closed ~2.0% lower. Buy-now-pay-later companies Afterpay and Zip shed 2.8% and 1.9% respectively, while Artificial Intelligence developer, Appen, lost 1.2%.

The Australian futures market points to a 0.37% fall today, driven by weaker overseas markets.

Overseas Markets

European sharemarkets were lower on Tuesday, weakened by a steep decline in the Information Technology sector. The sector had been trading at record highs due to the economic recovery and a positive earnings season, although this recent drop is said to be caused by investors profit-taking and shifting into more defensive areas of the market. As a result, the pan-European STOXX 600 closed 1.4% lower.

US sharemarkets closed mostly weaker overnight, with the Information Technology sector again weighing on the indices. Concerns regarding rising interest rates meant that investors shifted away from the high-flying growth stocks, with Apple losing 3.5%, Spotify shedding 3.1% and Amazon dropping 2.2%.

By the close of trade, the Dow Jones closed relatively flat and the S&P 500 fell 0.7%, while the NASDAQ lost 1.9%.

CNIS Perspective

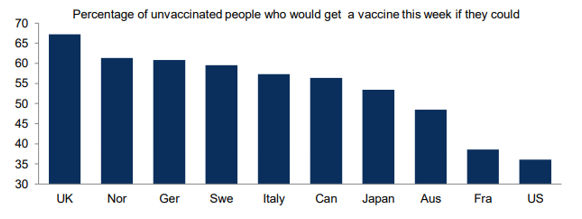

Mass rollouts of COVID-19 vaccines is key to achieving herd immunity. The faster a nation can achieve this goal, the more likely they are at easing border restrictions and increasing leisure activities, leading to greater economic performance.

However, herd immunity requires either infection or vaccination. Currently, targets to meeting herd immunity are estimated to be about ~70% of the population and may move higher again as contagious variants continue to develop.

However, the issue lies with the individual being willing to receive the jab and the concern for policymakers is, will we ever get there?

A recent study has shown large differences among countries, with the majority of unvaccinated UK citizens willing to receive the vaccine, but more reluctance among the US, Japan, France and Australia.

The less support for the jab, the reduced chances of reopening global borders and meeting herd immunity goals. Unless something changes, some countries, including our own, may never get there.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.