Morning Market Update - 7 June 2021

Cutcher & Neale

06 June 2021

17 July 2023

minutes

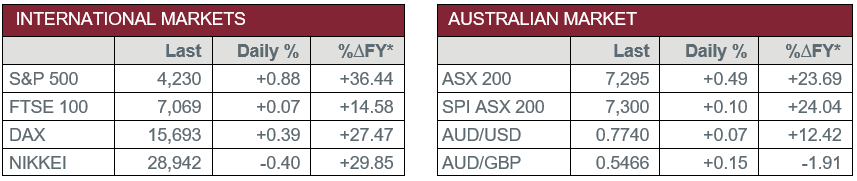

Pre-Open Data

Key Data for the Week

- Monday – CHINA – Trade Balance

- Tuesday – AUS – NAB Business Conditions and Confidence

- Tuesday – US – Trade balance

- Tuesday – EUR – Gross Domestic Product

- Wednesday – AUS – Building Approvals

- Wednesday – CHINA – Consumer Price Index

- Thursday – AUS – Consumer Inflation Expectations

- Thursday – EUR – ECB Monetary Policy

- Friday – UK – Industrial Production

Australian Market

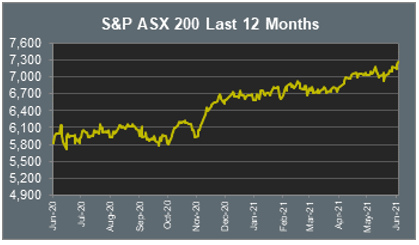

The Australian sharemarket added 0.5% on Friday to extend its recent run of gains. All sectors except Information Technology and Materials posted gains.

The Health Care and Utilities sectors were the best performers. CSL and Sonic Health Care rose 1.5% and 0.8% respectively, while AGL Energy added 1.9% and Origin Energy lifted 5.4%.

The Financials sector also outperformed, as the big four banks all rose between 1.3% and 1.5%. ANZ led the gains, while Commonwealth Bank closed at a new record high of $102.52.

Mining heavyweights were among the weakest performers as BHP, Fortescue Metals and Rio Tinto all lost between 1.7% and 2.0%. Gold miners also weakened; Newcrest Mining fell 2.1% and Northern Star Resources slumped 4.8% following a sell-off in the price of the precious metal.

The Australian futures market points to a 0.1% rise today, driven by stronger overseas markets on Friday.

Overseas Markets

European sharemarkets ended at a record high on Friday, as the broad based STOXX Europe 600 rose 0.4%. HelloFresh continued its recent strength to add 2.6% and close at a new record high. British Airways owner IAG slipped 0.9% after the UK removed Portugal from its ‘green list’ of travel destinations, while easyJet and Ryanair fell 2.5% and 1.1% respectively.

US sharemarkets also closed higher on Friday after weaker than expected payrolls data lowered concerns the Federal Reserve may tighten policy sooner than expected. Utilities was the only sector to close lower, while Information Technology stocks outperformed to help lift the market; Alphabet, Apple, Intel and Microsoft all rose between 1.9% and 2.0%. Cybersecurity companies were mixed; Fortinet added 3.0% and CrowdStrike lost 4.2%, while graphics processor manufacturer NVIDIA lifted 3.6%. Financial services companies posted strong gains; PayPal added 2.0%, MasterCard lifted 1.2% and Visa rose 0.9%, while e-commerce giants Amazon and Shopify both added 0.6%.

Over the week, the Dow Jones lifted 0.7%, the S&P 500 gained 0.6% and the NASDAQ added 0.5%.

CNIS Perspective

Nordic countries have agreed to come together and create the most sustainable and integrated region in the world. Sweden, Norway and Denmark are ranked 1st, 2nd and 3rd respectively out of 115 countries in the World Economic Forum’s 2021 Energy Transition Index. While other countries around the world have only recently been setting out plans to increase investment in sustainable projects and infrastructure, Nordic countries are years ahead of the curve.

Iceland has embraced geothermal heat, which powers 87% of hot water and heat for its households. In an effort to cut transportation costs and emissions, Iceland uses greenhouses to grow food, which produces 75% of the nation’s tomatoes and 90% of its cucumbers. Denmark is looking to export the electricity it collects from its offshore windfarms, as it now generates 1.5 times more than currently used. The excess energy will also be used to create green hydrogen from seawater.

In Norway, 75% of new car sales in 2020 were electric, whilst Australia had only 0.75%. As their countries work to decarbonise, Nordic companies are turning the region into the world’s green-tech laboratory. Digital start-ups in the region are developing software to support the green revolution, with technology entrepreneurs leaving lucrative careers to use code to take on the problems of climate change.

Norway and Finland are the only countries that invest as much as experts recommend in public clean energy research and development. Part of this success is pension funds across the Nordic region backing up their governments by committing to mobilise capital to invest in these green projects.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.