Morning Market Update - 9 February 2021

Cutcher & Neale

08 February 2021

17 July 2023

minutes

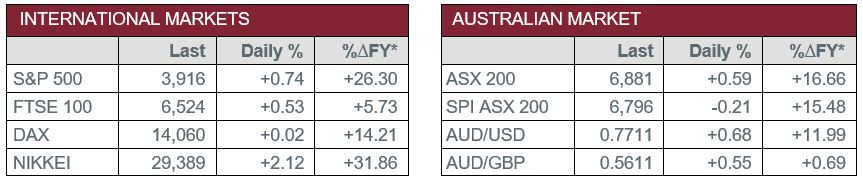

Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Tuesday – AUS – NAB Business Conditions & Confidence

- Tuesday – AUS – Westpac Consumer Confidence

- Wednesday – CHINA – Consumer Price Index

- Wednesday – US – Consumer Price Index

Australian Market

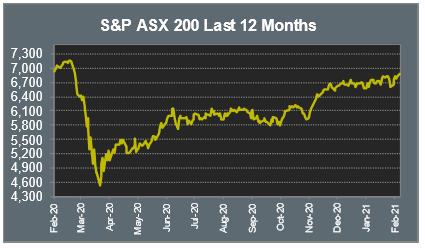

The Australian sharemarket reached 11-month highs throughout Monday’s session, closing up 0.6%. The Consumer Discretionary, Materials and Information Technology sectors outperformed, while defensive sectors closed in the red.

The mining heavyweights contributed to broader market gains on Monday; Rio Tinto climbed 3.4%, BHP added 2.4% and Fortescue Metals rose 2.1%. Goldminers were mixed; Newcrest Mining lifted 1.4% and Northern Star added 0.9%, while Evolution Mining lost 1.9%.

The Consumer Discretionary sector gained 1.5% following encouraging retail data that saw retail sales in value grow by 9.2% year on year. Super Retail Group jumped 4.0% and JB Hi-Fi added 2.1%, while Kogan.com and Wesfarmers lifted 1.2% and 1.0% respectively.

The Information Technology sector was lifted by solid gains among buy-now-pay-later companies. Afterpay closed up 1.5% to reach a fresh record high, while Zip Co rallied 12.9% following media reports that the company has been seeking greater exposure to US investors.

The Australian futures market points to a 0.21% fall today.

Overseas Markets

European sharemarkets advanced on Monday as the STOXX Europe 600 rose 0.3%. Dialog Semiconductor rallied 16% after Japanese chipmaker Renesas Electronics Corp agreed to purchase the company for €4.9 billion. The Financials sector enjoyed gains; Lloyds Bank and Deutsche Bank both added 1.9%, while Barclays Bank rose 0.2%.

US sharemarkets closed at record highs on overnight. The Information Technology sector outperformed; NVIDIA lifted 6.2% and Spotify added 4.2%, while Fortinet and Microsoft gained 2.5% and 0.1% respectively. Airline stocks rallied after reports the Democrat’s economic aid proposal may include airline payroll assistance; American Airlines jumped 3.4% and Delta Airlines climbed 5.1%. By the close of trade, the NASDAQ lifted 1.0%, while the Dow Jones and S&P 500 rose 0.8% and 0.7% respectively.

CNIS Perspective

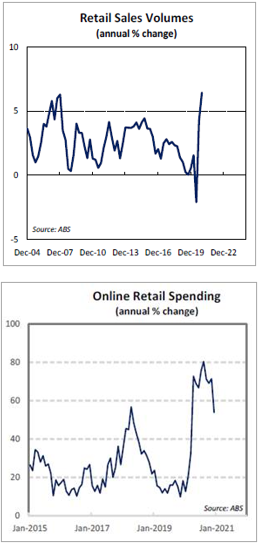

Australian retail sales data released Friday shows just how resilient the Australian consumer has been over the past year, despite the various lockdown measures and border restrictions imposed as a result of the COVID-19 pandemic.

During 2020, it became apparent the Australian economy, including consumer spending, was far more resilient than had been expected by policymakers.

Despite a 4.1% fall in retail sales volumes for the month of December, they rose 2.5% for the quarter and up 6.4% on a year ago, which is the largest annual growth rate in 16 years.

Retail sales by value grew 9.6% year on year, well above the long run average of 3.7% and significantly higher than the annual growth rate of 2.6% in December 2019.

Online spending was up 53.8% on a year ago, despite a 2.3% fall in December. During the height of the pandemic, online spending grew at around 80% per annum!

Consumer sentiment is likely to remain elevated, boosted by the current upturn in the housing market, low interest rates and a sub 7% unemployment rate. With all this positive sentiment and vaccine rollouts due to begin soon, retail sales should continue to grow over 2021 and we are already seeing some strong earnings results being released by Australian retailers in the current reporting season.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.