Morning Market Update - 9 November 2021

Cutcher & Neale

08 November 2021

17 July 2023

minutes

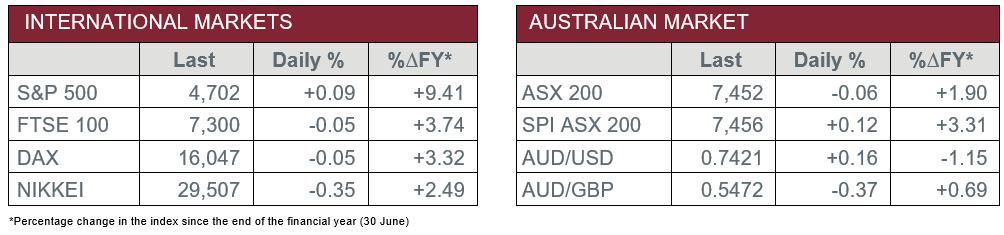

Pre-Open Data

Key Data for the Week

- Monday – EUR – Consumer Confidence increased to 18.3 in November, from 16.9 in October.

- Tuesday – US – Markit Manufacturing PMI

- Wednesday – AUS – Construction Work Done

- Wednesday – US – Gross Domestic Product

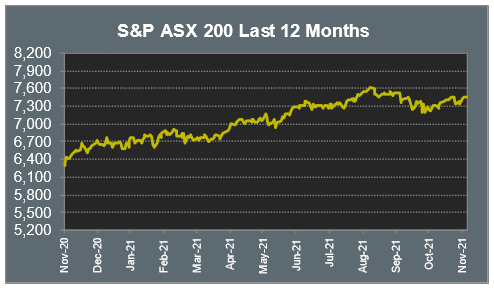

Australian Market

The Australian sharemarket lost 0.1% yesterday, as gains in the Energy and Industrials sector were overshadowed by losses among Technology and Health Care stocks.

Sydney Airport added 2.8% after the company announced it had entered an arrangement with the Sydney Aviation Alliance for a takeover valued at $23.6 billion. Auckland International Airport also benefitted from the news and closed the session 1.3% higher.

The Information Technology sector led the losses yesterday, down 1.7%. Buy-now-pay-later providers Afterpay and Zip shed 0.6% and 1.1% respectively. Artificial intelligence provider, Appen, slumped 3.7%, while Xero lost 4.9%.

A 0.8% loss in CSL weakened the Health Care sector. Cochlear conceded 2.1%, while Australian Clinical Labs and Sonic Healthcare closed down 2.9% and 2.2% respectively.

The Australian futures market points to a 0.12% rise today.

Overseas Markets

European sharemarkets closed relatively flat overnight, as gains were suppressed by some weak earnings reports. Oil prices rose after the US passed a US$1.3 trillion infrastructure bill; Royal Dutch Shell lifted 0.2% and TotalEnergies added 0.2%. Renewable energy companies enjoyed gains, as Siemens Gamesa Renewable Energy jumped 8.9%, while Vestas Wind Systems added 6.7%. By the close of trade, the UK FTSE 100 and the German DAX both slipped 0.5%, while the STOXX Europe 600 closed relatively flat.

US sharemarkets closed higher on Monday following the announcement Biden’s infrastructure bill had passed the Senate. As a result, the Materials and Industrials sectors enjoyed gains; Caterpillar Inc lifted 4.1%, while ChargePoint Holdings soared 11.8%. Despite this, Tesla shares dropped 4.8% following Elon Musk’s Twitter poll regarding whether he should sell a 10% stake in the business.

By the close of trade, the NASDAQ and the S&P 500 both lifted 0.1%, while the Dow Jones closed the session 0.3% higher.

CNIS Perspective

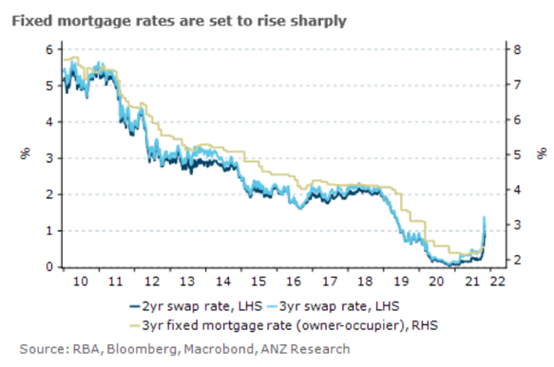

We have discussed the surprise lack of bond buying intervention by the RBA in recent weeks, as they stepped back from injecting funds into buying their target April 2024 three-year government bond.

This meant the RBA has allowed the government bond yield to be subject to market conditions, which has since spiked from a low and stable 0.1% yield, to over 0.5%.

In a practical sense, the results of withdrawing from injecting funds into buying their target government bond, along with withdrawing from the Term Funding Facility (TFF) which is providing low-cost funding to banks, hasn’t taken long to feed through to the end consumer, with significant activity in fixed interest home loan rates over the past week.

Last week, NAB, Commonwealth Bank and Westpac all lifted their fixed mortgage rates. This, in a way, is subsequently allowing domestic banks to be doing some of the early stimulus wind back on the RBA’s behalf.

Just because the RBA is not lifting the cash rate, doesn't mean that monetary policy remains stationary. The end to the TFF and yield target is flowing into fixed rate mortgages, which is effectively the beginning of ‘monetary tightening’.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.