Pre-Open Data

Key Data for the Week

- Monday – AUS – MI Inflation

- Tuesday – CHINA – Trade Balance

- Tuesday – AUS – RBA Interest Rate Decision

- Wednesday – JAPAN – Gross Domestic Product

- Thursday – CHINA – Consumer Price Index

- Thursday – US – Initial Jobless Claims

- Friday – US – Consumer Price Index

- Friday – UK – Industrial Productions

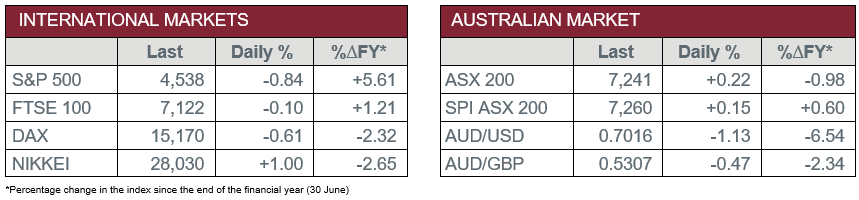

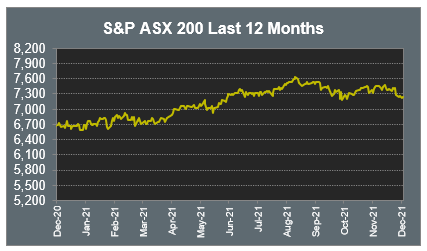

Australian Market

The Australian sharemarket lifted 0.2% on Friday in a mixed session of trade. The Energy sector was the strongest performer, up 1.6%, followed by Financials, which rose 1.0%.

The Materials sector gained 0.4%, lifted by mining heavyweights. Rio Tinto closed up 1.4% and BHP added 1.3% after the company’s board approved the removal of its double-listed structure, however, Fortescue Metals slipped 0.9%. Gold miners were weaker; Northern Star Resources fell 2.7% and Evolution Mining gave up 2.1%, while Newcrest Mining slipped 1.0%.

Health Care was the weakest sector on Friday, down 1.7%. Biotechnology heavyweight CSL shed 2.5% despite confirming it has been in acquisition negotiations with a foreign company, while Cochlear and Sonic Healthcare fell 1.3% and 1.2% respectively.

In company news, telecommunications company Tuas rallied 16.5% after the company released its first quarter results, which reported a strong outlook for the rollout of its 5G service and a rising subscriber base.

The Australian futures market points to a 0.15% rise today.

Overseas Markets

European sharemarkets eased on Friday. Energy was the only sector to advance; BP added 1.3%, while Royal Dutch Shell rose 0.9%. Banking stocks weakened; Deutsche Bank fell 1.7% and Lloyds Bank gave up 1.0%, while HSBC and Barclays Bank lost 0.4% and 0.3% respectively. By the close of trade, the UK FTSE 100 fell 0.1%, while the German DAX and STOXX Europe 600 both eased 0.6%.

US sharemarkets were also weaker on Friday, dragged lower by a sell-off in Technology stocks. NVIDIA gave up 4.5% and Fortinet shed 3.3%, while Microsoft and Apple slipped 2.0% and 1.2% respectively. However, Spotify bucked the trend to add 0.1%. E-signature software company DocuSign tumbled 42.2% after it reported fourth quarter guidance missed expectations.

The Health Care sector closed higher, up 0.3%; UnitedHealth Group added 1.1% and Johnson & Johnson rose 1.5%, while Bristol-Myers Squibb gained 1.6%. Renewable energy stocks weakened; Enphase Energy gave up 7.6%, while ChargePoint Holdings and SolarEdge Technologies shed 7.4% and 3.6% respectively. By the close of trade, the Dow Jones slipped 0.2% and the S&P 500 gave up 0.8%, while the NASDAQ lost 1.9%. Over the week, the Dow Jones and S&P 500 fell 0.9% and 1.2% respectively, while the NASDAQ slid 2.6%.

CNIS Perspective

In recent days, global markets have begun to readjust to recent comments that the Federal Reserve has removed itself from the belief that the inflation shock currently being experienced is temporary.

Annual wages growth in the US is running at over 4%, its highest level since before the Global Financial Crisis in 2008. At the same time, consumer inflation expectations have also spiked, to a consensus of over 4% in the next three years.

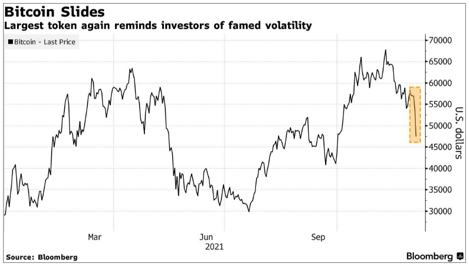

Higher growth investments have felt the impact of the Federal Reserve’s change in view more than most. However, the larger moves have been seen in cryptocurrencies, culminating with a crypto flash crash experienced over the weekend, where the two largest tokens, Bitcoin and Ethereum, experienced falls of over 15% in a 24-hour period.

Digital currencies are here to stay, but flash crashes in coins aren’t uncommon. Those willing to purchase these more speculative asset classes need to understand the volatile swings in returns that can transpire.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners

From locum shifts to running your own practice: When your cover needs an upgrade