Pre-Open Data

Key Data for the Week

Key economic data released this week:

- Wednesday – AUS – Construction Work Done fell 2.6% in the September quarter.

- Wednesday – US – Gross Domestic Product rebounded at an annualised pace of 33.1% in Q3.

- Thursday – EUR – ECB Monetary Policy Meeting

- Thursday – US – Initial Jobless Claims

Australian Market

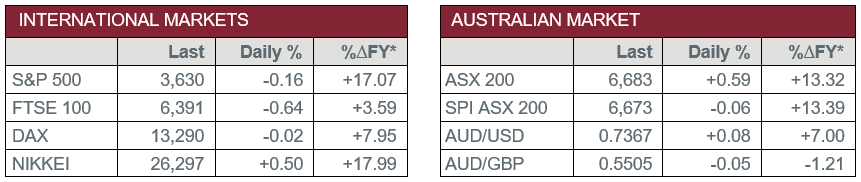

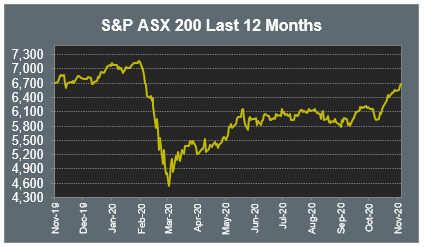

The Australian sharemarket rose 0.59% yesterday, as the local ASX 200 closed within a point of where it started the year. Gains were broad based, as all sectors ended the session positive, with Energy the strongest performer. Despite a surge in coronavirus cases in the US and northern hemisphere, the price of oil has strengthened ~20% in November, amid hopes a vaccine will boost demand for the commodity. Origin Energy increased 4.0%, while Woodside Petroleum rose 3.0% and Santos climbed 2.7%.

Travel stocks continued to rise, further boosted by Queensland’s decision to reopen borders with the greater Sydney area next month; Webjet rose 4.7%, Qantas lifted 3.9% and Flight Centre added 3.0%.

Mining heavyweights BHP and Rio Tinto jumped 3.0% and 1.1% respectively to boost the Materials sector, while Fortescue Metals rose 2.8%. The Telecommunications sector was boosted by Telstra, which lifted 1.3%.

Clothing multinational Kathmandu fell 4.2%, after the company revealed a 24.1% drop in retail sales this financial year, affected by coronavirus restrictions in Australia and overseas.

The Australian futures market points to a 0.06% fall today.

Overseas Markets

European sharemarkets eased on Wednesday, after the European Union’s chief executive said the European Commission could not guarantee there will be a trade pact with Great Britain following the latter’s exit from the EU. However, UK water company United Utilities strengthened 2.3%, after it proposed a higher interim dividend and HelloFresh surged 5.2%. Industrials stocks Veolia Environnement and CRH strengthened 3.7% and 1.9% respectively, while Tesco added 0.8%. The broad based STOXX Europe 600 slipped 0.1% and the UK FTSE 100 slid 0.6%, while the German DAX was flat.

US sharemarkets were mixed overnight, as disappointing jobs data limited positive investor sentiment ahead of the Thanksgiving Day holiday. Gains were led by the Consumer Discretionary, Information Technology and Consumer Staples sectors, while Energy, Materials and Industrials were among the laggards. Earnings results were mixed among retailers; luxury department store chain Nordstrom soared 11.2% after the company reported better than expected EPS, while Gap sank 19.6% after it missed fiscal third quarter earnings estimates. PayPal gained 4.1%, Tesla rose 3.2%, Amazon climbed 2.2% and Apple added 0.8%. By the close of trade, the NASDAQ rose 0.5% to end the session at a fresh record closing high, however, the Dow Jones dropped 0.6% and the S&P 500 slipped 0.2%.

CNIS Perspective

Global bellwether US stock index, the Dow Industrial Average, surpassed 30,000 for the first time on Wednesday, as investors relaxed from the political uncertainty that had built up leading into the US Federal election. The Trump administration now appears to be offering its ‘sincere’ assistance after the sitting president formally cleared the way for an orderly transfer of power, following a fortnight’s delay.

Besides ranting about the election, President Donald Trump has been busy creating a tougher stance on international relations with countries such as China and Cuba, as well as withdrawing troops from Afghanistan. However, these stances may not last long.

President-elect Joe Biden has named Janet Yellen as America's next Secretary of the Treasury, the ex-Chair of the US Federal Reserve from 2014-18, as she commands respect among both Democrats and Republicans and is a much more market friendly nomination than Elizabeth Warren, previously a leading candidate for the position.

After four years of a highly abnormal administration filled with nepotism, policy by Twitter, a turnstile of senior government operators and an abrasive foreign policy, it appears as though we are returning to normalcy at the White House, which is lifting sentiment and filtering into asset prices.

Should you wish to discuss this or any other investment related matter, please contact your Investment Services Team on (02) 4928 8500.

Disclaimer

The material contained in this publication is the nature of the general comment only, and neither purports, nor is intended to be advice on any particular matter. Persons should not act nor rely upon any information contained in or implied by this publication without seeking appropriate professional advice which relates specifically to his/her particular circumstances. Cutcher & Neale Investment Services Pty Limited expressly disclaim all and any liability to any person, whether a client of Cutcher & Neale Investment Services Pty Limited or not, who acts or fails to act as a consequence of reliance upon the whole or any part of this publication.

Cutcher & Neale Investment Services Pty Limited ABN 38 107 536 783 is a Corporate Authorised Representative of Cutcher & Neale Financial Services Pty Ltd ABN 22 160 682 879 AFSL 433814.

A fully funded opportunity to improve efficiency for regional NSW manufacturers

Start strong in January: Why smart tax planning begins well before June

AI Explainer: Who’s Behind the Tools You Keep Hearing About?

Ready for Next-Level Automation? See What’s New in Ostendo 243

Thinking ahead, acting today: Must-know succession strategies for practice owners